It’s 2024 and the phrase ‘power couple’ gets thrown around as frequently as ‘Artificial Intelligence’. Yet, no one seems to agree on a proper definition. Is it celebrities who have tremendous power to influence? Is it a politically oriented duo like Hillary and Bill of yesteryear? Or is it something more soul inspiring where partners complement each other’s strengths and thrive as a unit?

Let’s put a pin in that debate and instead present this year’s indisputable new power couple: the hyperscaler and the independent power producer (IPP). Surprised? When this type of relationship goes ‘nuclear’, it doesn’t create a paparazzi circus! Instead, it generates substantial shareholder value.

One of the biggest obstacles for hyper scalers like Microsoft, Amazon and Alphabet in their pursuit of Generative AI leadership is power generation and transmission. Data center servers that utilize GPU chips consume multiples of the power of traditional servers. According to the International Energy Agency, a Chat GPT query needs roughly 3 watt-hours of electricity, while a traditional search on Google only requires 0.3 watt-hours to process. Despite U.S. electricity consumption flat-lining over the last 15 years, industry consultants forecasts that by 2030, power demand in the U.S. will climb 15% from current levels – in large part due to the data center buildout.

As our Equity Research technology team highlights in the recently published article hyperscalers appear committed to their ambitious sustainability goals. These companies need reliable, continuous sources of energy to power their facilities. Vogtle Units 3 and 4 in Georgia are the most recent U.S. nuclear power sources to come on-line - a decade after construction commenced and at nearly $20 billion over budget. Mega-cap tech companies require a timely response from utilities to support the hundreds of billions of dollars they are cumulatively spending on data center infrastructure.

Last month Microsoft (MSFT) and Constellation Energy (CEG) announced an agreement that would re-open Three Mile Island (TMI) Unit 1, capable of generating 835 megawatts of electricity, with MSFT committing to 20 years of power consumption from the nuclear facility. TMI Unit 1 was closed in 2019 due to a lack of economic viability. While one dozen U.S. nuclear plants shut down between 2012-2021, the Inflation Reduction Act of 2022 provided production tax credits as an incentive for nuclear power capacity to remain online. In the case of TMI Unit 1, we estimate the real kicker is that MSFT will likely pay roughly double the current regional market rate for power – for the next two decades! CEG expects to spend about $1.6 billion through 2028, inclusive of nuclear fuel to restart the plant, which will also require government and industry approval.

The irony of the TMI Unit 1 restart is lost on no one with a few gray hairs. In 1979, TMI Unit 2 was permanently shut down after a partial core meltdown in what became known as the worst accident in U.S. nuclear power plant history. This incident ironically occurred only 12 days after the theatrical release of ‘The China Syndrome’, a fictional thriller about the risks of a nuclear power plant meltdown. The public's 'fear gauge' regarding nuclear power climbed to an all-time high. It's not surprising that only a handful of new U.S. nuclear reactors have been put into operation since 1979.

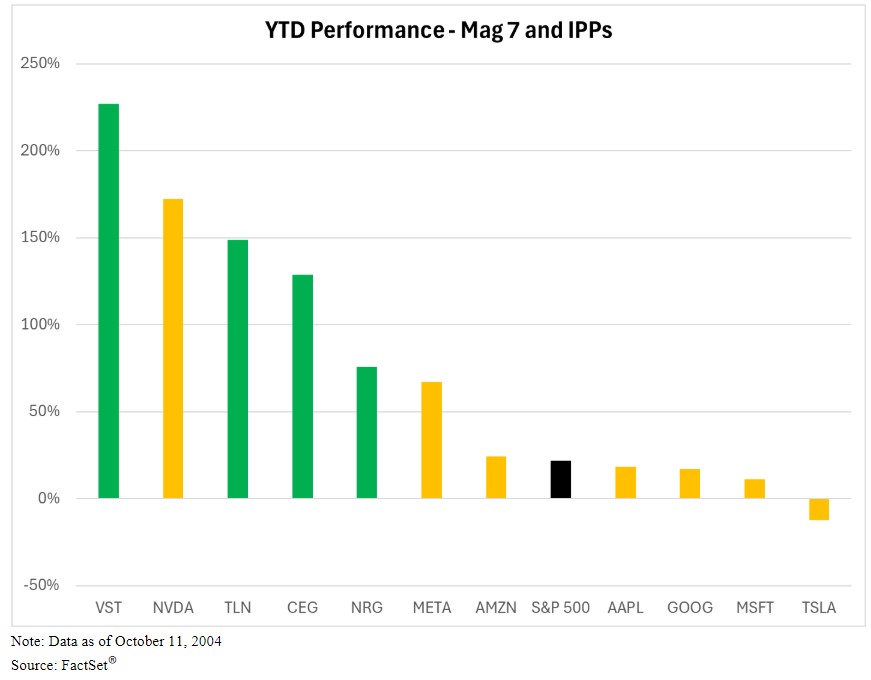

The market responded to the CEG/MSFT deal with an outpouring of approval; CEG climbed 22% on the day and is up more than 125% YTD. CEG, which spun out of Exelon in early 2022, owns the largest fleet of nuclear power capacity in the U.S., while 90% of its entire fleet is carbon-free. CEG, which we have owned in Large-Cap Sustainable Value (LCSV)1 since the strategy’s inception two years ago, is one of four publicly-traded IPPs – the others being Vistra (VST), NRG Energy (NRG) and Talen Energy (TLN – held in our Small-Cap Value2 strategy). NRG is the only IPP that doesn’t have nuclear power in its arsenal and is still up 75% this year – better than all the Mag 7 stocks (except for NVDA). VST has appreciated more than 200% YTD. The S&P 500® utilities SPDR® is up 30% this year – the best of any sector - supported by the performance of the IPPs.

The allure of the IPPs is that unlike regulated utilities, they benefit from rising market rates for power supply. Power prices for regulated utilities are determined by state regulators. In addition, rising demand creates the opportunity for more secure, long-term power purchase agreements at an attractive return on investment for IPPs.

Talen, which emerged from bankruptcy last year inked a deal with Amazon in 2024. Its crown jewel is a 90% ownership interest in the Susquehanna nuclear power plant. Talen sold its datacenter campus that is collocated with the power plant to Amazon Web Services and will provide the new owner with energy via a 10-year power purchase agreement – also assumed at an above-market price, although not as high as MSFT’s.

Mike Poggi, portfolio manager of LCSV continues to like CEG’s approach to shareholder value creation. “We like the consistent free cash flow generation of CEG’s long-life nuclear assets, its prudent balance sheet and disciplined approach to capital allocation. These attributes make CEG somewhat unique within the utility sector. CEG is the logical partner of choice in helping its customers meet their renewable energy goals.”

The next time you hear the phrase ‘power couple’, perhaps you’ll envision Constellation and Microsoft rather than Taylor and Travis!

Thanks for reading, and remember to never skip a Beat – Eric

Source: Factset®. FactSet is a registered trademark of FactSet Research Systems, Inc

1 This is based on a representative Large-Cap Sustainable Value account.

2This is based on a representative Small-Cap Value account.

Stocks: Alphabet (GOOG), Amazon (AMZN), Constellation Energy (CEG), Exelon Corp (EXC), NextEra Energy Inc (NEE), NRG Energy (NRG), Microsoft (MSFT), Talen Energy (TLN), Vistra Corp (VST), NVIDIA (NVDA), Meta Platforms (META), Apple (AAPL), and Tesla (TSLA)

Magnificent Seven stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

Company information is sourced from each company’s earnings call.

The views and opinions expressed in this podcast are those of the speaker(s) and do not necessarily reflect those of Brown Advisory. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. The information provided in this podcast is not intended to be and should not be considered a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Sectors are based on the Global Industry Classification Standard (GICS) sector classification system. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS), “GICS” and “GICS Direct” are service marks of Standard & Poor’s and MSCI. “GICS” is a trademark of MSCI and Standard & Poor’s.

The S&P 500® Index represents the large-cap segment of the U.S. equity markets and consists of approximately 500 leading companies in leading industries of the U.S. economy. Criteria evaluated include market capitalization, financial viability, liquidity, public float, sector representation and corporate structure. An index constituent must also be considered a U.S. company. These trademarks have been licensed to S&P Dow Jones Indices LLC. S&P, Dow Jones Indices LLC, Dow Jones, S&P and their respective affiliates (collectively "S&P Dow Jones Indices") do not sponsor, endorse, sell, or promote any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. This document does not constitute an offer of services in jurisdictions where S&P Dow Jones Indices does not have the necessary licenses. S&P Dow Jones Indices receives compensation in connection with licensing its indices to third parties.

An investor cannot invest directly into an index.

Terms and Definitions:

Earnings per share (EPS) is a company's net income subtracted by preferred dividends and then divided by the number of common shares it has outstanding.