The breeze feels gentler, the birds chirp their dawn chorus and ephemeral cherry blossoms will soon flourish. Yes, spring is upon us! The outdoors suddenly pivots from foe to dear friend this time of year. Yet recent headlines make this change of seasons somewhat bittersweet; a study published in the journal Science shows a stunning decline in the population of butterflies – another wonder of spring - across the U.S. since the turn of the century.

I’m not ashamed to express my sorrow at the thought of our gardens bereft of these “angels of nature”. However, the implications would go well beyond my own emotional condition. Butterflies play an essential role in pollinating flowers, crops and other plants. Their demise could have far-reaching implications, from reduced plant diversity to disruption of the animal food chain, including for humans. Life as we know it could change meaningfully without these graceful and delicate creatures.

In the 1960s, meteorologist Edward Lorenz coined the term “The Butterfly Effect” to indicate small changes in conditions within a large, complex system can lead to significant variations in outcome. His famous example (less dystopian than mine) was of a butterfly flapping its wings in Brazil causing a tornado to form in Texas. Small things matter, and we are all connected to something bigger.

This theory applies to economics and stock markets just as practically as the weather (it’s no wonder that meteorologists and Wall Street strategists have similar track records in predicting the future). In recent weeks, the broad communication of one-liners from people of influence has proven to be just as effective as the flapping of butterfly wings in producing a ripple effect – in this case, impacting consumer confidence, consumer spending, corporate fundamentals and eventually equity prices.

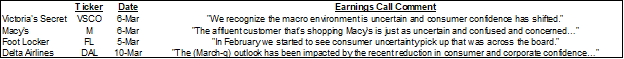

The administration’s seesaw announcements on tariffs since the end of January have been disorienting to anyone attempting to stay current. One would need all of their fingers and toes (and possibly eyes and ears) to count the number of times the message regarding our trading relationship with Canada and Mexico has changed. No less an authority than Warren Buffett recently offered that, “Over time, (tariffs) are a tax on goods…the tooth fairy doesn’t pay ‘em!” A handful of companies that have reported results in recent weeks have verified the inflationary nature of these actions.

Source: Company transcripts as of March 11, 2025.

Separately, government workers were thrown a curve ball in February when the Office of Personal Management sent an email asking for a list of their weekly accomplishments. While key agencies instructed employees to ignore the directive, the Head of Department of Government Efficiency (DOGE) warned that, “Failure to respond will be taken as a resignation.” A few days later, the administration informed federal agencies it would now be “voluntary” for employees to respond to the email. Subsequently, federal workers received a second round of emails with the same request. For this group of roughly three million Americans, job security has rarely been as uncertain.

Similarly rattled are a portion of the 67 million Americans who collect Social Security benefits. According to former Social Security Administration (SSA) Commissioner Martin O’Malley, DOGE’s plans to cut thousands of jobs at the agency may lead to a disruption of benefits for some. O’Malley’s warning, “People should start saving now”, was widely broadcasted by financial media sources.

Inflation uncertainty from start-stop tariff announcements, federal job security concerns and questions around receipt of retirement benefits have seemingly poked a hole in the unflappable American consumer. In February the Conference Board’s Consumer Confidence Index registered its largest monthly decline since August 2021. Similarly, the Commerce Department recently reported the largest monthly decline in consumer spending in nearly four years. These weaker data points are corroborated by recent corporate earnings comments.

Source: Company transcripts as of March 11, 2025.

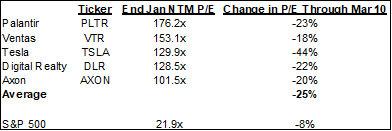

Unsurprisingly, stock market participants have become unnerved by all of the above. The VIX – used by investors as a barometer for market uncertainty – has climbed 70% from end of January through March 10. The S&P 500® Index is down about 7% over this time, with all of the Magnificent 71 except for Apple (AAPL) underperforming the market. High valuation stocks have seen their multiples correct meaningfully over this short period. The table below highlights the five highest P/E multiple companies in the S&P 500 Index, and their levels of multiple contraction from January 31 – March 10.

Source: FactSet as of March 11, 2025.

Fed Chairman Jay Powell seemed to temporarily calm investors’ nerves on Friday, March 7 by assuring the American public that the “Fed is focused on separating the signal from the noise as the outlook evolves.” Yet, the market sell-off continued following President Trump’s comments of “a period of transition” for the economy, followed by additional tariff announcements on steel and aluminum from Canada.

Given the speed that soundbites travel and their incessant flow it’s highly likely that by the time you read this, new comments from people of influence will impact the economy and stock markets in unpredictable ways.

Our own efforts to separate signal from noise center around developing multiple scenario analyses for individual companies that attempt to predict fundamental performance during periods of macroeconomic prosperity, duress or somewhere in-between. With a longer investment horizon than many market participants, we can view heightened price volatility through the lens of opportunity. Historically speaking, when security prices of high-quality businesses retreat towards levels that reflect long-term economic despair, the greatest alpha can be created.

Of course, it is a fool’s game to attempt to predict what will come next for either the economy or the stock market. The same could be said for the fortunes of the butterfly. Its population could quickly recover with the support of conservation efforts. Similarly, U.S. consumer spending has shown to be very resilient over time and can surely recover with some “habitat restoration” of its own.

Poet Pablo Neruda writes, “You can cut all the flowers but you cannot keep spring from coming.” Similarly, companies with enduring competitive advantages and profitable growth may encounter periods of price volatility, but we believe their value will flourish over time.

Thanks for reading, and remember to never skip a Beat – Eric

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

The S&P 500® Index represents the large-cap segment of the U.S. equity markets and consists of approximately 500 leading companies in leading industries of the U.S. economy. Criteria evaluated include market capitalization, financial viability, liquidity, public float, sector representation and corporate structure. An index constituent must also be considered a U.S. company. These trademarks have been licensed to S&P Dow Jones Indices LLC. S&P, Dow Jones Indices LLC, Dow Jones, S&P and their respective affiliates (collectively "S&P Dow Jones Indices") do not sponsor, endorse, sell, or promote any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. This document does not constitute an offer of services in jurisdictions where S&P Dow Jones Indices does not have the necessary licenses. S&P Dow Jones Indices receives compensation in connection with licensing its indices to third parties.

An investor cannot invest directly into an index.

Price-Earnings Ratio (P/E Ratio) is the ratio of the share of a company’s stock compared to its per-share earnings. P/E calculations presented use FY2 earnings estimates; FY1 estimates refer to the next unreported fiscal year, and FY2 estimates refer to the fiscal year following FY1.

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options.

Alpha is the excess return of an investment relative to the return of a benchmark index.

Volatility is a statistical measure of the dispersion of returns for a given security or market index. Volatility can either be measured by using the standard deviation or variance between returns from that same security or market index.

1Magnificent Seven stocks: Alphabet (GOOG), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA).

Source: FactSet®. FactSet is a registered trademark of FactSet Research Systems, Inc