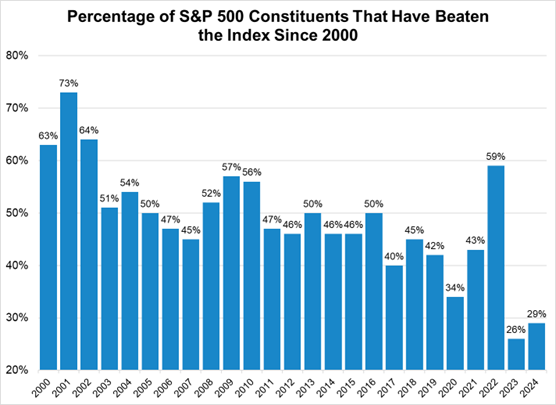

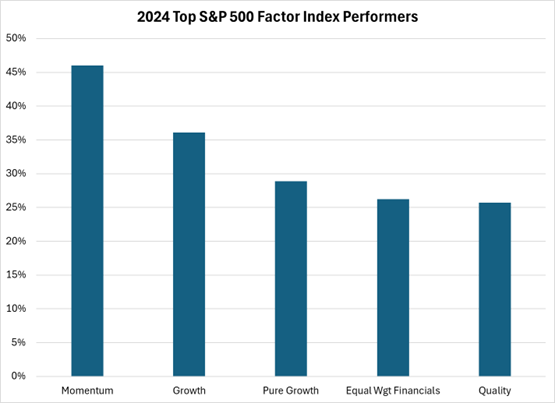

Happy New Year! I admit, it feels good to turn the calendar following a challenging relative year for many active equity managers. According to Morningstar, fewer than one-quarter of large-cap blend funds outperformed the S&P 500® Index last year, while only one-fifth have done so over the past three and five-year periods, respectively. Two primary culprits of this trend are index concentration and momentum. In each of the last two years, fewer than 30% of S&P 500 Index constituents have done better than the overall Index – the lowest “success rate” of any time thus far this century – creating a challenging environment for stock pickers. In addition, the momentum factor has been the best performing S&P 500 Index factor over both the past year and last five years, suggesting this narrow group of outperforming stocks has continued to lead the market.

Source:Morningstar and Bloomberg as of 12/31/2024.

For decades, professional investors have categorized their competitive advantages into three broad concepts: informational, analytical and/or behavioral. Based on the unique market backdrop described above, and recent technological advancements, it’s likely a good time to re-evaluate whether these areas where active managers have historically described having an “edge” remain intact.

Informational Advantage

Most investment firms who have written on this topic in recent years have concluded that Artificial Intelligence and Big Data have effectively competed away any informational advantage. After all, it seems reasonable to conclude that in an era of widely accessible, real-time information, having an edge in this area would be fleeting at best. However, before writing it off completely, let’s consider how ‘information’ has evolved over the course of time.

Over the holidays, I had the opportunity to read Nexus: A Brief History of Information Networks from the Stone Age to AI by historian and philosopher Yuval Noah Harari (best known for authoring Sapiens: A Brief History of Humankind). In this tome, Harari describes how humanity has successfully utilized information starting about 70,000 years ago, while also expressing concern as to whether mankind will be able to safely and successfully harness the power of Artificial Intelligence (AI).

One of Harari’s primary concerns is that the explosion of content generated by AI software increases the risk of widely disseminated false information. Remarkably, according to a study by Amazon Web Services in mid-2024, roughly 57% of all web-based text is generated or translated through an AI algorithm. In addition, researchers from Oxford and Cambridge recently found that when Gen AI queries rely solely on content produced by Gen AI, the quality of responses sharply declines, often producing hallucinations. Lastly, a 2023 study published in Science Advances found that while humans are effective at recognizing the falsity of human-produced information, we tend to regard AI-produced misinformation as accurate.

An investor’s ability to distinguish between fiction and fact (or signal from noise) through fundamental research has always been a key determinant in sound portfolio decision making. Today, the importance of this effort is further pronounced by the vast increase of information, and the speed at which it is disseminated. While not a true informational advantage, those investors who are extremely discerning stand to analyze more accurate information than others.

Analytical Advantage

In Nexus, Harari recounts the story of AlphaGo, an AI program created to play the complex, ancient game of Go. In 2016, AlphaGo was competing against South Korean champion Lee Sedol, when on Move 37 the computer made a ‘very strange move’ according to commentators. The move was even described as a ‘mistake’ at the time. Fast forward to the end of the game, when it became clear that this odd move, which had not been previously considered by the greatest Go players over perhaps thousands of years, was pivotal to AlphaGo’s victory.

An analytical advantage by definition is taking the same information and processing it more effectively or successfully than others. The AlphaGo example demonstrates AI’s ability to consider possibilities beyond the human mind. And that was way back in 2016 – six years before the introduction of OpenAI’s ChatGPT. Thus, it is conceivable that the investor with the “best” algo could sense opportunities through creative and rapid analysis. However, how repeatable is the algo’s success, and does that success get quickly competed away by other programs that are observing leading-edge technology? An openness to technological innovation regarding analytics would appear to be “table stakes” for investors today. However, it’s more challenging to express how a particular investor would have a sustained analytical advantage over time.

Behavioral Advantage

Today, most investment firms highlight “behavioral edge” as the primary advantage remaining of the original three, often driven by a lengthier investment time horizon, a rigorous investment process that protects against decision-making bias and a culture of adaptation to an ever-changing world. I would concur that when executed well, a behavioral edge is an essential ingredient for superior long-term investment performance. In fact, I suspect that the opportunity associated with this category is greater than ever before.

According to Quantified Strategies, 60-75% of daily U.S. stock market trading volume – including high frequency trading - is currently performed by algorithms. These programs attempt to leverage technological speed and computational resources that human-to-human interaction cannot match. However, computer-to-computer trading activity can lead to irrational outcomes, as was experienced in May 2010 with the infamous “Flash Crash”. During that episode, the Dow Jones Industrial Average suddenly declined 9% driven by high-frequency trading algorithms engaging in a series of rapid trades. While the algorithms involved acted according to their programs, they responded in ways their designers had not anticipated when combined at scale.

Let’s now combine the increased risk of the dissemination of erroneous information as previously discussed with the growing trend of computer-to-computer trading activity. While we cannot predict how the market may respond to these factors at any given moment, it stands to reason that irrational price action – perhaps not as severe as the Flash Crash, but meaningful on a security-by-security basis – will grow in frequency. In the same vein, new sources of information – inclusive of social media posts – can influence and lead to short-term security mispricing. It’s hard to fathom how a celebrity tweet would change the intrinsic value of a business, but we’ve all seen markets respond to many such comments in recent years.

We hold to Warren Buffett’s famous comment, “In the short run, the market is a voting machine but in the long run, it is a weighing machine”. While analyses based on fact may lead to uncomfortable, unfavorable relative outcomes in the short or intermediate term – especially given the environment described above – they can also generate highly favorable results over time.

In conclusion, recent-year trends of momentum-led and concentrated market performance have challenged portfolio managers’ relative results. Some of the competitive advantages once expressed by investment firms have or will likely be competed away due to the wide dissemination of real-time information and the computational prowess offered by artificial intelligence. However, the concept of “behavioral advantage” remains intact, and is perhaps more powerful than ever before for managers who can remain patient, meticulously distinguish signal from vast amounts of noise, and are willing to invest against the herd when irrational price action occurs.

Happy New Year! And remember to never skip a Beat – Eric

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

The views expressed are solely for informational purposes and do not represent an endorsement of any political party or candidate.

Sectors are based on the Global Industry Classification Standard (GICS) sector classification system. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS), “GICS” and “GICS Direct” are service marks of Standard & Poor’s and MSCI. “GICS” is a trademark of MSCI and Standard & Poor’s.

The S&P 500® Index represents the large-cap segment of the U.S. equity markets and consists of approximately 500 leading companies in leading industries of the U.S. economy. Criteria evaluated include market capitalization, financial viability, liquidity, public float, sector representation and corporate structure. An index constituent must also be considered a U.S. company. These trademarks have been licensed to S&P Dow Jones Indices LLC. S&P, Dow Jones Indices LLC, Dow Jones, S&P and their respective affiliates (collectively "S&P Dow Jones Indices") do not sponsor, endorse, sell, or promote any investment fund or other investment vehicle that is offered by third parties and that seeks to provide an investment return based on the performance of any index. This document does not constitute an offer of services in jurisdictions where S&P Dow Jones Indices does not have the necessary licenses. S&P Dow Jones Indices receives compensation in connection with licensing its indices to third parties.

An investor cannot invest directly into an index.