Let’s face it, folks: one month is just a speck of dust in relation to the multi-century history of the stock market. In fact, we tend to measure the performance of our internal strategies over three, five and ten-year periods, and sometimes even longer. Still, I would be remiss not to highlight an unexpectedly positive January to start the year, and perhaps even set the course for equity markets in 2023.

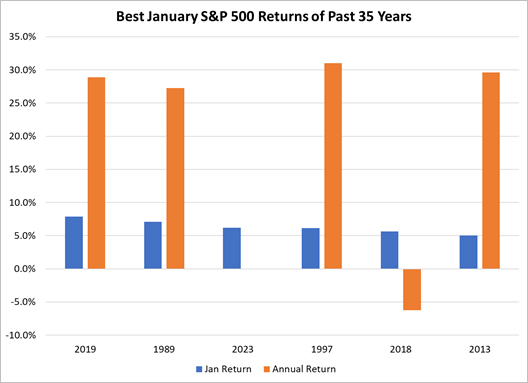

Despite very legitimate concerns of an impending economic recession, equity markets in January were as resilient as ever, with the S&P 500® Index posting a 6.2% return. Believe it or not, last month was the third-best January return for the Index of the past 35 years. In fact, it’s only the fourth time since 1989 that the S&P 500 Index returned more than 6% in the month of January. The other three times (1989, 1997, 2019) the market finished the year up at least 27%. A comparable 2023 would put the S&P 500 Index at an all-time high by year-end and close to the vaunted 5,000 level. I don’t remember reading any year-end Wall Street prognostications of the market hitting all-time highs in 2023, do you?

Source: FactSet. January Returns are Jan 1 to 31 of respective years.

Annual returns measured as Jan 1 to Dec 31 of respective years. As of Feb 7, 2023.

I’m clearly in an increasingly buoyant mood – Jay Powell recently stated that the “disinflationary process has started”, while adding the U.S. will likely avoid recession this year. Corporate earnings season once again looks to be “better than feared”, while negative earnings revisions remain relatively muted for 2023. The eurozone is suddenly on course to avoid an all-but-previously-guaranteed recession, thanks in large part to a mild winter. According to the International Monetary Fund, the U.K. will be the only G7 country poised to fall into recession this year with many commentators arguing that this may only be for a brief period. The point is that some of the largest economies in the world are expected to fare better than originally thought.

To be fair, the exceptionally strong January jobs report could very well burst my bubble. The Fed may be in less of a rush to turn dovish after the announcement that the U.S. added more than half a million jobs last month, which could reduce the likelihood of a soft landing. However, I’d like to share with you some “potent quotes” from executives during this earnings season that support what appears to remain a resilient economy and a reasonably favorable outlook for investors.

Tim Cook, Apple CEO

“…We believe iPhone would have grown during the quarter had it not been for the supply shortages.”

This was a comment Cook made during Q&A; in the December quarter, iPhone revenue (more than half of total company revenue) declined 8% from prior year, and fell short of Street expectations. Yet Cook argued that supply challenges are now in the rear-view, and Apple expects its customers to continue to pay a premium for its products and services. The stock bounced strongly on the report.

Howard Schultz, Starbucks Interim CEO

“At a time when people are generally trading down and there's a lot of discounting going on, we had the highest average ticket I believe in our history in the month of December.”

While the market was initially critical of the near-term COVID-driven weakness in China, the company’s 10% same store sales comparable in North America was impressive, and consumers continue to pay up for coffee customization.

Michael Miebach, Mastercard CEO

“…We expect the consumer to be relatively resilient…going forward in our base case…we continue to see a fairly resilient European consumer.”

Visa similarly stated on its call that “business trends have been remarkably stable…we’re not changing our views (on the macro).” The soft-landing narrative suddenly appears to be the global base case.

Fabrizio Freda, Estee Lauder CEO

“While the March quarter is set to be more variable (in China) because of the high level of COVID cases, we now anticipate even stronger organic sales growth as of the fourth (June) quarter as recovery evolves…(we) anticipate a gradual return to more fulsome brick-and-mortar traffic by (June).”

Estee’s March quarter EPS guide is nearly 80% below consensus, yet the stock largely got a “free pass” on the expectation of a China recovery in the June quarter.

Darren Woods, Exxon Mobil CEO

“We are under-investing as an industry in (oil). And in the depletion business we are not keeping up with that depletion or not offsetting it and covering the growth. You find yourself in tight markets.”

Exxon’s comments have been echoed across the oil and gas landscape this earnings season, perhaps setting up for a risk to global economic recovery, and/or creating a healthy backdrop for multi-year oilfield services investments.

Thanks for reading, and remember to never skip a Beat - Eric

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

The S&P 500® Index represents the large-cap segment of the U.S. equity markets and consists of approximately 500 leading companies in leading industries of the U.S. economy. Criteria evaluated include market capitalization, financial viability, liquidity, public float, sector representation and corporate structure. An index constituent must also be considered a U.S. company. Standard & Poor’s, S&P, and S&P 500® are trademarks/service marks of MSCI and Standard & Poor’s.

Factset® is a registered trademark of Factset Research Systems, Inc.