The managers of Brown Advisory’s Large-Cap Sustainable Growth strategy discuss how their sustainable investing approach has helped them preserve capital during down markets.

“Sustainable investing” means different things to different people. Some sustainable investors want to make a positive impact on the world,others want to align their portfolio with a specific mission or set of values, and still others simply want to screen out businesses and behaviors from the portfolio that they find objectionable. None of these goals are “right” or “wrong,” and those who work in sustainable investing generally embrace the different goals, viewpoints and methodologies that have evolved over the years.

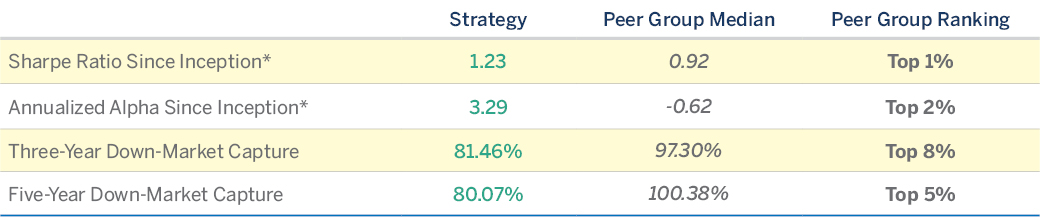

In our work managing Brown Advisory’s Large-Cap Sustainable Growth strategy, sustainable investing is first and foremost about performance. For nearly a decade, we have combined fundamental and sustainable research to build a portfolio that seeks to outperform the Russell 1000® Growth Index. Our risk-adjusted results are particularly important to us, and as of Sept. 30, 2019, the strategy’s Sharpe ratio and annualized alpha (two commonly cited measures of risk-adjusted performance) since inception were ranked in the top 1% and 2%, respectively, of eVestment’s large-growth manager universe (see chart below).

A major driver of our performance has been our consistent ability to perform well during down markets. Over the last three years, we achieved down-market capture of just 81%; this ratio measures the strategy’s return vs. its benchmark during periods of market decline. That result places us among the top 8% of our large-growth peers, according to eVestment.

Many investors are concerned about the aging bull market, and as a result want to understand how their investments might perform in a downturn. We are not making a prediction about the market’s near-term path, but we believe that our holdings can weather a downturn relatively well. Our experience has taught us that there is a strong link between the sustainable characteristics of our portfolio companies, and their resilience during difficult market periods. Here, we will discuss some of the reasons why we think that link is so strong, and provide a number of examples of portfolio companies whose sustainable business models have directly contributed to their strength in declining markets.

STRONG FOUNDATION

The Large-Cap Sustainable Growth strategy has generated strong risk-adjusted performance over time. The strategy’s Sharpe ratio and annualized alpha since its inception place it among the top 2% of large-growth U.S. equity managers. Its three-year down-market capture ratio ranks among the top 8% of managers in that peer group.

*Strategy inception date: 12/31/09. Source: eVestment. The performance rankings may not be representative of any one client’s experience because the ranking reflects an average of the accounts that make up the composite and is provided as supplemental information. Managers voluntarily populate performance data into the eVestment database for inclusion, and the number of managers in each period only consists of managers that were in the universe for that entire period. The number of managers in the peer group comparisons listed above are as follows: 257 for sharpe ratio, 257 for annualized alpha, 297 for three-year down-market capture, and 289 for five-year down-market capture. Please see the last page for full universe description. The analysis is provided as supplemental information.

Sustainable Investing and Downside Protection

Every sustainable business is somewhat unique, but we tend to look for a variety of factors that, in our view, contribute to steady, consistent growth and profitability in both healthy and challenging markets. We cover three of these factors below.

Companies that offer their customers a compelling “sustainable return on investment.” Many of our portfolio companies help their customers address sustainability challenges like climate risk, energy reliability, water management, commodity price volatility and many other issues.

These businesses often hold up well in down markets. One reason is that many sustainability challenges represent real and meaningful costs: Energy costs money, materials cost money, and, increasingly, water and its use cost money. Many of our portfolio companies help their customers save money in these areas. This tends to foster strong customer retention—even during low points in the business cycle when these customers are looking for ways to cut spending.

A good example is Ecolab, which offers water, energy and sanitation solutions to customers in many different sectors of the economy. In 2018 alone, Ecolab reported that it had helped customers conserve 164.5 billion gallons of water (equivalent to the yearly drinking water needs of more than 568m people), 46.5 million pounds of waste, and 16.1 trillion BTUs of energy. Because it delivers clear and measurable payback to its customers, Ecolab has generally navigated tougher periods without losing much business. Coming out of the global financial crisis, the company’s revenue declined only 4% in 2009, and it was able to improve its gross margins and EBIT during that period. In the years after the recession, Ecolab delivered double-digit top-line growth. Its revenue mix includes a healthy base of consumables that generate recurring revenue, which contributes to its revenue visibility and stability from year to year.

Ball is a leading global supplier in the metal packaging solutions market. Ball’s positive impact stems from both the inherent advantages of aluminum packaging vs. glass or plastic and its own sustainable innovations. Aluminum is infinitely recyclable, and thanks to proactive recycling programs around the world, the average aluminum can produced today contains 68% recycled content. Producing recycled aluminum cans uses about 5% of the energy required to produce cans from virgin materials. Additionally, Ball is a big reason that aluminum cans are so lightweight today. Ball reduced the weight of its 12-ounce cans by 40% since the 1970s, helping many other companies also achieve their sustainability goals.

Companies that use sustainability to build supply chain advantages. As companies mature and gain leadership in their markets, supply chain mastery becomes critical to their efforts to improve or even maintain their margins. A number of our companies use sustainable thinking as they select suppliers, and go several steps further, developing clear operational standards rooted in sustainability and then helping their suppliers achieve those standards. By cementing their vendor relationships in this manner, companies can make their supply chains more reliable, reduce the volatility of their costs, and, in some cases, enhance their overall brand.

Companies that use sustainability to inform long-term capital allocation decisions. Every management team claims a long-term focus, yet many run their businesses with a “don’t fix what isn’t broken” mentality and avoid taking the bold steps that could redirect capital toward a more profitable path. Environmental and social challenges are creating huge markets all over the world, and we have been attracted to a number of companies based on their smart and substantial investments to embrace those markets. Of course, our evaluation of a company’s strategy is based on many different factors, but we take note when companies link capital allocation to opportunities stemming from long-term, sustainable trends.

Shifting capital from a mature business to a newer opportunity may seem riskier than standing pat. But we find that companies that make these decisions wisely are the ones that are built to last. Conversely, there is often a good deal of embedded downside risk in a company that remains focused on declining industries that face slowing growth, shrinking margins or competitive disruption.

The Bottom Line: Sustainable = Resilient

As noted earlier, investing in companies with these sustainable characteristics has helped us generate top-decile risk-adjusted returns and down-market capture. Of course, other factors have contributed to these results as well: We are disciplined about capping exposure to any single company, we emphasize consistency of growth over absolute growth rates, and we proactively optimize position sizes across the portfolio as prices change and conditions for each portfolio company evolve. In our view, all of these factors have helped our portfolio hold up relatively well when the market has stumbled.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or asset classes mentioned. It should not be assumed that investments in such securities or asset classes have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. Private investments mentioned in this article may only be available for qualified purchasers and accredited investors. All charts, economic and market forecasts presented herein are for illustrative purposes only. Note that this data does not represent any Brown Advisory investment offerings.

The eVestment U.S. Large-Cap Growth Equity universe classification (“universe”) includes U.S. equity strategies that invest primarily in large capitalization stocks with fundamental growth characteristics or products that invest in growth stocks/sectors. The expected benchmarks for this universe would include the Russell 1000®, or S&P 500. Managers in this category will typically indicate a “Primary Capitalization Emphasis” equal to Large-Cap and a “Primary Style Emphasis” equal to Growth. The minimum criteria necessary for inclusion in an eVestment Universe are 1) minimum of one year of performance history, and 2) updated portfolio characteristics for the product. All products meeting the criteria are evaluated for inclusion. Managers voluntarily populate performance data into the database for inclusion, and the number of managers in each period consists only of managers that provided that data point and were in the universe for that entire period. For example, the number of managers that provided turnover and active share statistics as of 12/31/2011 differed from 262 to 25, respectively, despite representing the same eVestment U.S. large-cap growth equity universe. Historical manager data for active share, which has become more widely used since 2009, is notably limited prior to 2014.

Return on Investment (ROI) is the ratio between the net profit and cost of investment resulting from an investment of some resource. A high ROI means the investment’s gains compare favorably to its cost.

The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

“FTSE®”, “Russell®”, “MTS®”, “FTSE TMX®” and “FTSE Russell” and other service marks and trademarks related to the FTSE or Russell indexes are trademarks of the London Stock Exchange Group companies.