The end of the calendar year is traditionally a time of reflection, and for us it is a chance to sit with clients, review progress, discuss the events shaping the investment landscape, and revisit goals for both the near term and the long term.

Unfortunately, 2022 has been a painful experience for many. On the geopolitical front, the world is grappling with a devastating war in Ukraine and its many global implications; the domestic political backdrop in the U.S. (home to many of our clients) has further divided American society; and, although we have emerged from the pandemic, we are all feeling the lasting effects of its disruption across society, and likely will for years to come.

Meanwhile, the global economy has been deeply impacted by the confluence of all of these events; the most significant near-term result, in our view, has been the return of inflation as a truly global economic threat for the first time in decades. Central banks all over the world have responded with aggressive rate hikes to combat rising prices, which further exacerbated a market decline that began with the invasion of Ukraine.

In brief, 2022 was an extremely challenging year. Many of our clients expressed deep distress about external events, and in many cases their general anxiety and unease after two years of COVID-19 lockdowns only made things harder. So, it is understandable why some clients would wonder whether they need to a) revisit, and b) potentially overhaul their long-term plans.

In our experience, it always makes sense to periodically revisit our clients’ long-term plans; however, if those plans were well-constructed in the first place, we should rarely need to go back and overhaul them due to external market conditions. One of the key traits of a good plan is that it can succeed in a wide range of “good” and “bad” economic scenarios; further, one of the most important benefits of a good plan is that it can stop you from reacting too strongly to volatile markets or temporary economic conditions. But life inevitably brings changes to every client’s risk tolerance—usually because their circumstances, aspirations and obligations evolve over time—so there may be very valid reasons for making extensive adjustments to an existing plan.

When we offer guidance to clients about possible plan changes, we use a clear, three-step process. This process often serves as the equivalent of deep breathing and meditation in the face of perceived chaos. It is all too easy for emotions to contaminate financial conversations, especially in such a volatile market, and we believe the use of a disciplined thought process can counteract those natural emotional reactions.

- Continually assess where you stand today against your current financial and generational plans

We have a number of tools we use to help clients think through their initial goal-setting and planning, and to review those goals and plans on an ongoing basis. We often lead clients through a values discovery exercise, and/or work with them to develop a family mission statement and strategic plan; each of these steps and deliverables seek to address important values and non-financial considerations like family governance, important family philosophies, educational priorities, philanthropic goals or sustainable investing intentions, in addition to addressing financial objectives as one would expect. These exercises invite a long-term perspective, open communication and the active engagement of all family members.

- Regularly review and adjust near-term tactical plans to build confidence in the face of current volatility

Here, we want to emphasize the difference between adjusting a tactical plan and overhauling a strategic plan; the latter is rarely necessary, while the former is a natural part of a healthy, ongoing investment process.

When responding tactically to a challenging market, we try to keep our focus on the things we can control. Some of the steps that we are discussing with a wide range of clients this year include:- Review your portfolio

- Validate its consistency with your long-term plan

- Ensure it adequately addresses your near-term liquidity needs and,

- Confirm it is positioned appropriately to ride through market volatility and inflationary pressures

- Consider the deferral of large capital expenditures if these purchases compromise your comfort around liquidity

- Rethink lines of credit and other lending arrangements in light of rising interest rates

- Revisit your risk management plans (update insurance programs and review the operation of family business entities) and,

- Reevaluate your state of residency (or international residency/citizenship) – determine the most advantageous location from a personal, familial, business and tax standpoint

- Review your portfolio

- Consider opportunities that could accelerate progress on longer-term goals within the context of the current economic and policy cycle.

For those prepared, and willing, challenging markets and an uncertain economy can provide unique opportunities. With that backdrop, we highlight several positive factors:

- Income Tax

Despite recent efforts to raise individual income tax rates, the highest marginal rate remains at 37%. And proposed changes to the taxation of carried interest and gains on the sale of Qualified Small Business Stock failed to win approval. Because rate brackets are adjusted upward for inflation, some taxpayers in 2023 may find more of their income is taxed at lower brackets, reducing their overall tax bill. - Tax Loss Harvesting

While none of us want to see a stock value drop below its cost basis, such a decline does present an opportunity to bank a tax deduction by selling the stock and creating a tax loss to offset current or future taxable income. Tax losses can also expedite the rebounding of client portfolios by reducing the tax drag on future growth. If the security is still viewed as attractive over the long-term, the position can be repurchased after 30 days – or the sale can be used to raise additional cash to reset liquidity reserves. - Charitable Giving

With the expiration of the CARES Act allowance for increased income tax deductibility for certain charitable contributions, these rules remain largely unaltered from historic norms and allow clients to utilize direct gifts, donor-advised funds and private foundations to achieve philanthropic goals and generate tax deductions. In the right circumstances, split-interest trusts, like Charitable Remainder Trusts and Charitable Lead Trusts, remain effective vehicles to combine investment goals with charitable objectives and to generate income and/or enhance valuable tax deductions. - Roth IRA Conversions

The owner of a traditional IRA may elect to convert to a Roth IRA, which offers tax-free withdrawals and no required annual distributions for the original account holder. Because the tax cost of the conversion is based on the value of the account when converted, these conversions may be particularly attractive when asset values are temporarily depressed. Planning for Roth IRA conversions is best executed when the resulting taxes can be paid from non-IRA assets and local taxes are considered if a change in tax residence is considered in the future. - Estate Tax Rules

Despite Congressional threats to change estate and gift tax rules, these laws remain unaltered. One positive result of the unwelcomed inflation is the wealth transfer tax exemptions and exclusion – already inflation-adjusted – are set to meaningfully increase on January 1, 2023. Gift, estate and generation-skipping tax exemptions are expected to increase from $12.06 million to $12.92 million, meaning that in 2023 a married couple should have almost $1.8 million of additional exemption to apply to wealth transfers. And, the gift tax annual exclusion should jump 6.25%, from $16,000 to $17,000. That’s an additional $2,000 a married couple can give each year, tax-free, to any child, grandchild, or other beneficiary. - Valuations

While decreased asset values create near-term challenges for our clients, such declines may also allow transfers between family generations at lower valuations, enhancing the utility of wealth transfer tax exemptions. When these assets are transferred through family limited partnerships or LLCs, the gifts are often eligible for valuation discounting. - Interest Rates on Intra-Family Loans

The Applicable Federal Rates (AFRs), which govern the interest rates on intra-family loans and the discount rates applicable to various wealth transfer planning techniques, are certainly meaningfully higher now than in recent times, but they still remain low from a historical perspective. For intra-family loans originating in November 2022, the long-term AFR (applicable to loans exceeding 9 years in term) is 3.92% - higher than the 1.86% rate in November 2021, but still an attractive proposition, in our view, for a younger generation who can lock in their cost of capital at under 4% for 10, 20, or 30 years. - Grantor Retained Annuity Trusts (GRATs) and Qualified Personal Residence Trusts (QPRTs)

While the discount rate (sometimes referred to as the “hurdle rate”) applicable to GRATs is higher today than years’ past (4.8% for November 2022 vs 0.4% in 2020), the current depressed value of equities means the likelihood of exceeding that hurdle rate over a two- to three-year GRAT term remains high. And as one door closes, another opens – while many of the wealth transfer techniques we’ve employed in recent years, like GRATs, typically work well with low AFRs, other strategies, like Qualified Personal Residence Trusts (QPRTs) generally perform better with today’s higher rates. Parents considering the transfer of the value of a primary or secondary home to children may find with softening real estate values and a higher AFR, a QPRT may provide a meaningful planning opportunity to explore.

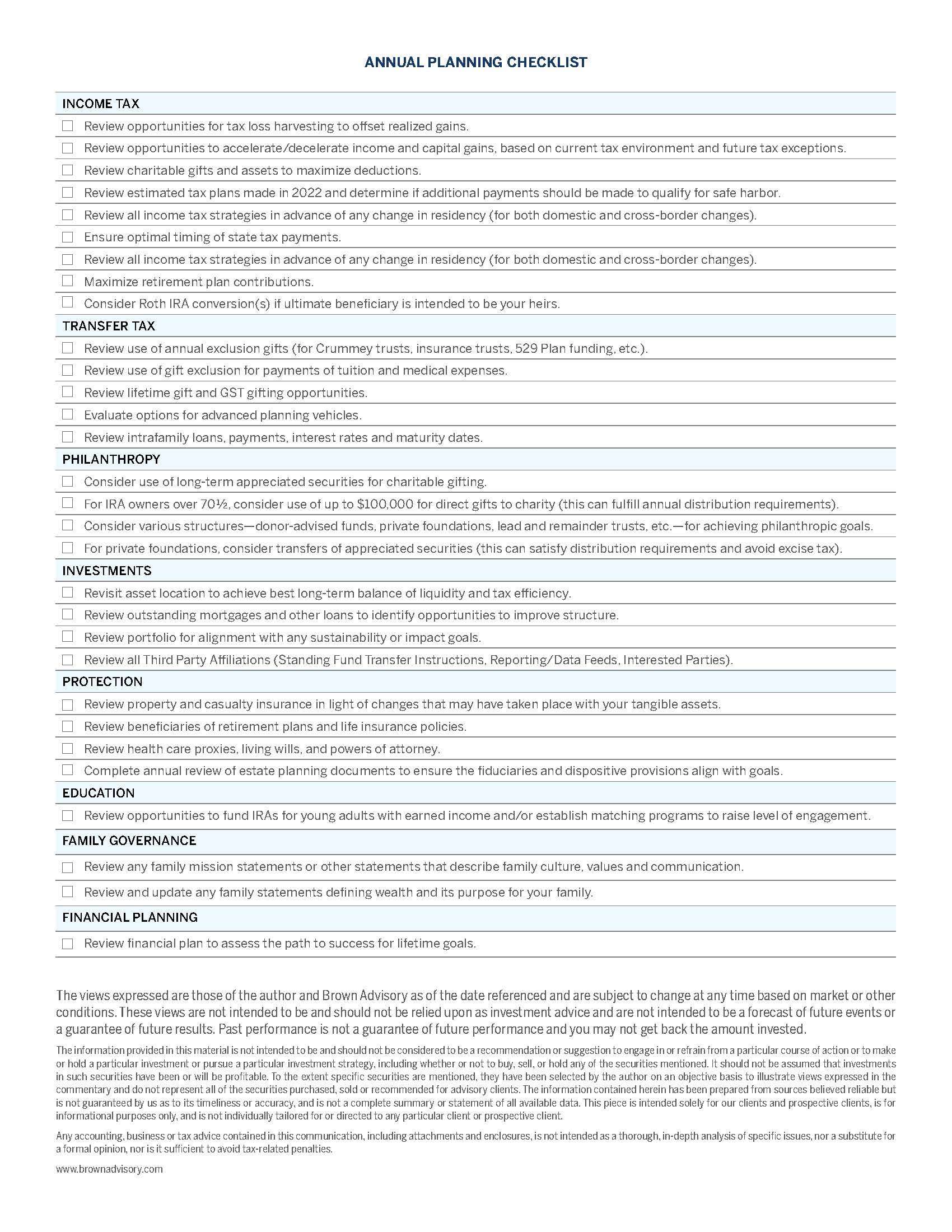

As we have done in prior years, we are attaching our year-end planning checklist. While it is focused primarily on tax and investment matters, it is also helpful in identifying key focus areas for the next few weeks as we begin the countdown to 2023.

Society faces historical challenges right now, and many of these challenges represent both risk and opportunity for investors. We believe that investors who can “keep calm and carry on”—in other words, rise above the emotions of the moment and proceed with a clear plan—can navigate this period successfully. Of course, this is easier said than done. In our thousands of meetings with clients this year, their fears about what comes next, and what we should do about it, have been a common and frequent theme.

But that is why we are here.

By addressing changing conditions calmly, and from within the boundaries of an existing long-term plan, we not only help clients grapple with elevated risks, but we can create a context for those clients—many of whom are large, multigenerational families—to come together and advance their larger goals for legacy, impact or philanthropy. These conversations will not magically erase the painful events of the past few years, but in our experience, they often lead to exciting new paths forward for the families with whom we work. We look forward to discussing these matters with you—as well as any other topics you deem important—in the weeks ahead.

To download a copy of the checklist, please click here.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.