Fast Reading

- Decarbonization has long been a priority in the aviation sector, driven by goals of light weighting and fuel efficiency. However, the sector now presents increasing opportunities due to regulatory risks, rising fuel prices, and customer pressure.

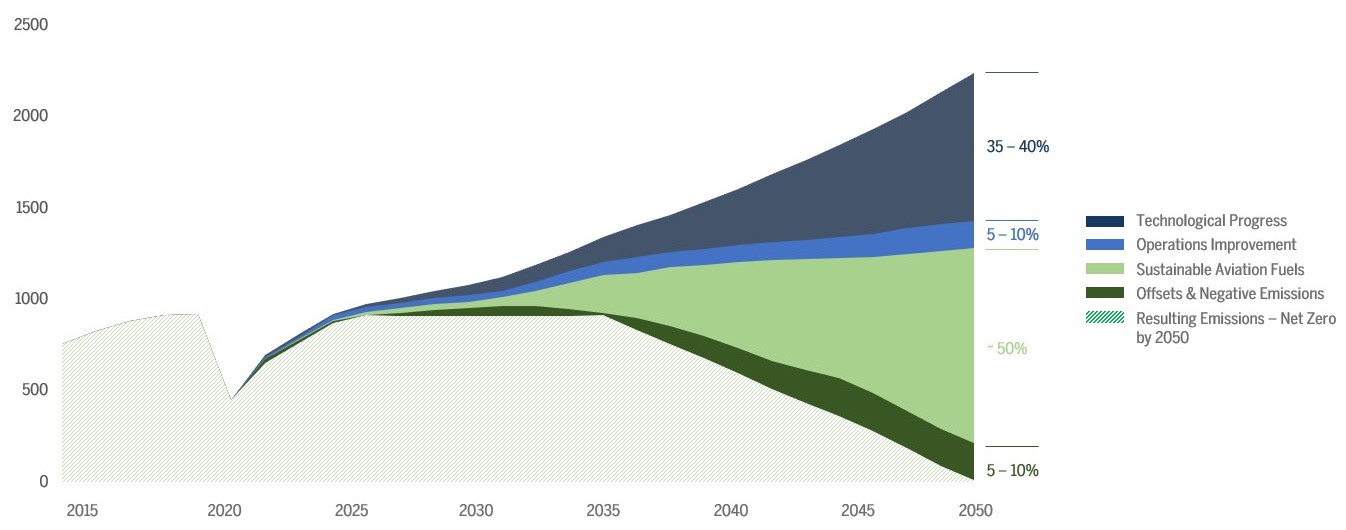

- Achieving net zero carbon emissions by 2050 will require a coordinated effort from the entire industry – manufacturers, airlines, airports and air navigation services – as well as significant government support. We believe the key driver will be the adoption of Sustainable Aviation Fuel (SAF), which can reduce emissions by up to 80%, though its success faces barriers today around scale and affordability.

- We invest in a number of companies at the forefront of innovation in the sector, such as engine manufacturers, that we believe are well positioned to lead in sustainable aviation. By integrating decarbonization into their strategies, these companies can reduce regulatory costs and capitalize on opportunities in fuel efficiency and light weighting, driving strong and durable growth opportunities.

Decarbonizing aviation poses one of the biggest challenges to the energy transition, and paradoxically one of the most salient investment opportunities. Unlike electricity, which can reduce carbon through use of renewables and nuclear, or road transportation through electrification, aviation has no simple switch. Although air travel accounts for just 2-3% of global CO2 emissions, this figure is deceivingly modest.1 It is important to consider that approximately 10% of the global population is responsible for over 60% of all flights, however this imbalance is expected to shift as global economies continue to expand.2 Therefore, addressing aviation emissions is crucial to achieving broader climate goals.

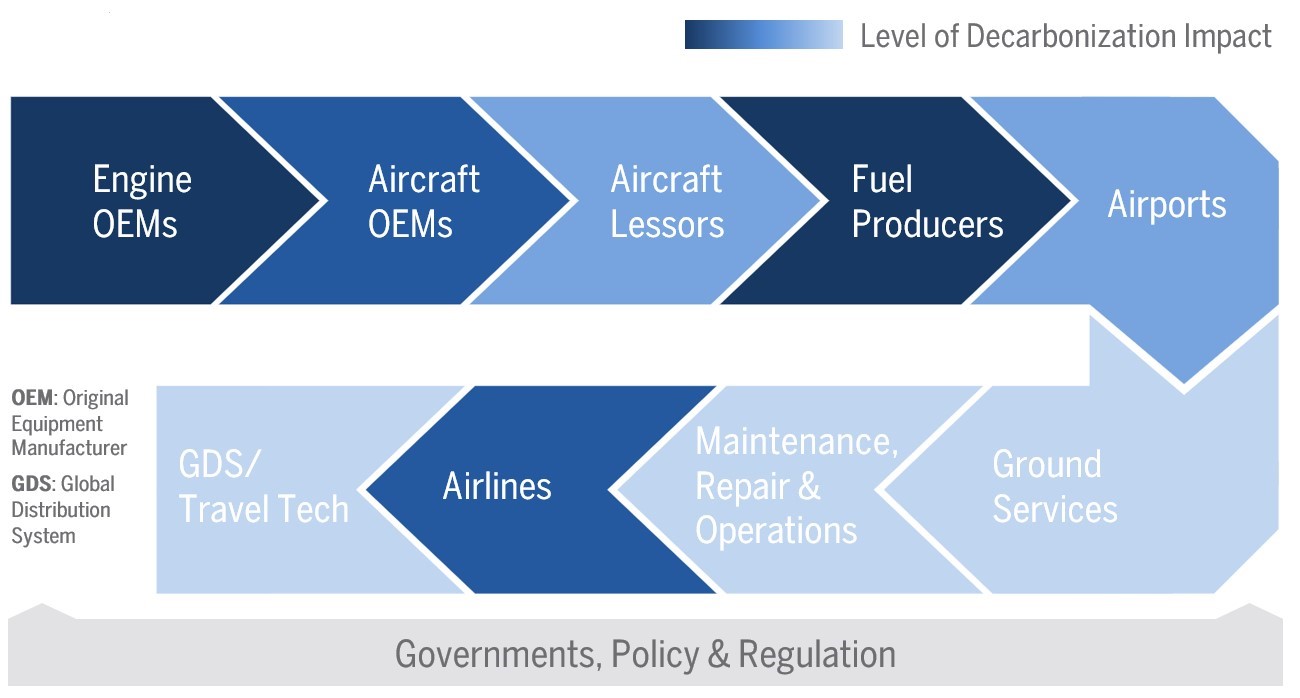

Considering the various nuances and multiple drivers of decarbonization, our objective in this piece is to identify and highlight the investment opportunities that will likely emerge from the aviation value chain (Fig 1) as it shifts toward a more sustainable business model. A critical question we attempt to address is identifying the tipping point as well as the technologies that could significantly influence long-term performance.

The Challenge of Sustainable Aviation

Decarbonization serves as both a strategy for mitigating climate change and a process intended to greatly reduce or eradicate carbon dioxide (CO2) and other greenhouse gas (GHG) emissions from the atmosphere.3 In 2021, the aviation sector set a target of achieving net-zero carbon emissions by 2050. This goal was adopted by the International Air Transport Association (IATA) and later endorsed by the International Civil Aviation Association (ICAO).4 We believe success will require the combined efforts of the entire industry.

Airline traffic has now recovered to pre-pandemic levels and according to the ICAO’s recent estimation, aviation demand is projected to grow around 4.3% per year over the next 20 years, with demand for air passenger journeys potentially exceeding 10 billion by 2050.5 Asia Pacific is projected to experience the fastest growth in passenger numbers and contribute to over half of the net increase in global passenger numbers by 2043.6 Recognizing that air transport is at the heart of economic growth and will continue to play a critical role in global development, it is crucial to address the increasing environmental impact. As the aviation customer base diversifies and grows, there is an increasing need for aviation stakeholders, such as Original Equipment Manufacturers (OEMs), airports and airlines to play a leading role in decarbonizing air transportation and enhancing overall performance.

FIG 1: AVIATION VALUE CHAIN

Source: Brown Advisory Analysis, Company Reports, as of 12/31/2024. This illustration does not include all players in the industry’s value chain.

FIG 2: GREEN HOUSE GAS EMISSIONS FROM COMMERCIAL AVIATION (MtCO2E)

Estimations vary.

Adapted from: Safran, p. 24, 2024 Capital Markets Day, as of 12/05/2024; https://www.safran-group.com/calendar/capital-markets-day-2024

Current Efforts

Growth within the aviation sector has historically been driven by light weighting and fuel efficiency. However, we now believe it presents increasing opportunities due to the real risks associated with regulation, increasing fuel prices, and growing customer pressure.

To date, the main evolutions have come from improvements in aircraft and engine design and technology; fuel efficiency per passenger; asset utilization and increased passenger load factors. For example, since the very beginnings of CFM International, a joint venture between Safran and GE Aerospace, its engines have reduced CO2 emissions* by more than 40%.7 However, despite progress over the past 40 years, improvements in energy intensity have not been sufficient to counterbalance energy demand growth within aviation (Jevons paradox), a trend we see across many industries.8 Fuel carbon intensity — how much CO2 is emitted per unit energy (gCO2eq per MJ)— has not changed at all. We used standard jet fuel in 1990 and are (broadly) using the same stuff today. From 2010-19, average fuel efficiency per revenue tonne Kilometer (RTK) equivalent travelled improved by 1.8% due to introduction of more efficient aircraft and engines.9 This has not kept up with demand growth which grew at an average rate of 5% between 2010-19. Efficiency will need to improve at rate more than 2% through 2030.10

While ambitions are clear across the aviation sector, the interdependent nature of the industry means that players must collaborate to achieve their decarbonization commitments. More than 95% of an aircraft OEM's emissions come from their Scope 3 downstream emissions, primarily from airline fuel burn, underscoring the critical role of OEMs, such as Safran and GE Aerospace, and suppliers in supporting airlines and providing solutions.11 The industry's collective ambition to decarbonize is bolstered by this interdependency, which also highlights the importance of advancing innovation in sustainable technology to gain a competitive edge in customer outcomes, market access, and potential cost efficiencies.

For instance, one part of our thesis in GE Aerospace is the CFM RISE (Revolutionary Innovation for Sustainable Engines) Program. This initiative focuses on revolutionary open fan architecture, with the goal to reduce fuel consumption and CO2 emissions by more than 20% compared to the best engine in service today, as well as ensuring compatibility with alternative energy sources like Sustainable Aviation Fuels (SAF).12 However, it is worth noting that despite GE Aerospace's advancements in developing engines that are 100% compatible with SAF, the impact of these engines, in part, depends on the supply side of the industry, including fuel producers and distributors, also meeting these new standards. In this way, on top of the innovation, we believe it is both the timing and collaboration across the industry that are essential for the successful decarbonization of the aviation industry.

Investment Opportunities

Going forward, we believe there are three primary ways to drive decarbonization, each of which has a varying timeline and thus real impact:

Sustainable Aviation Fuels

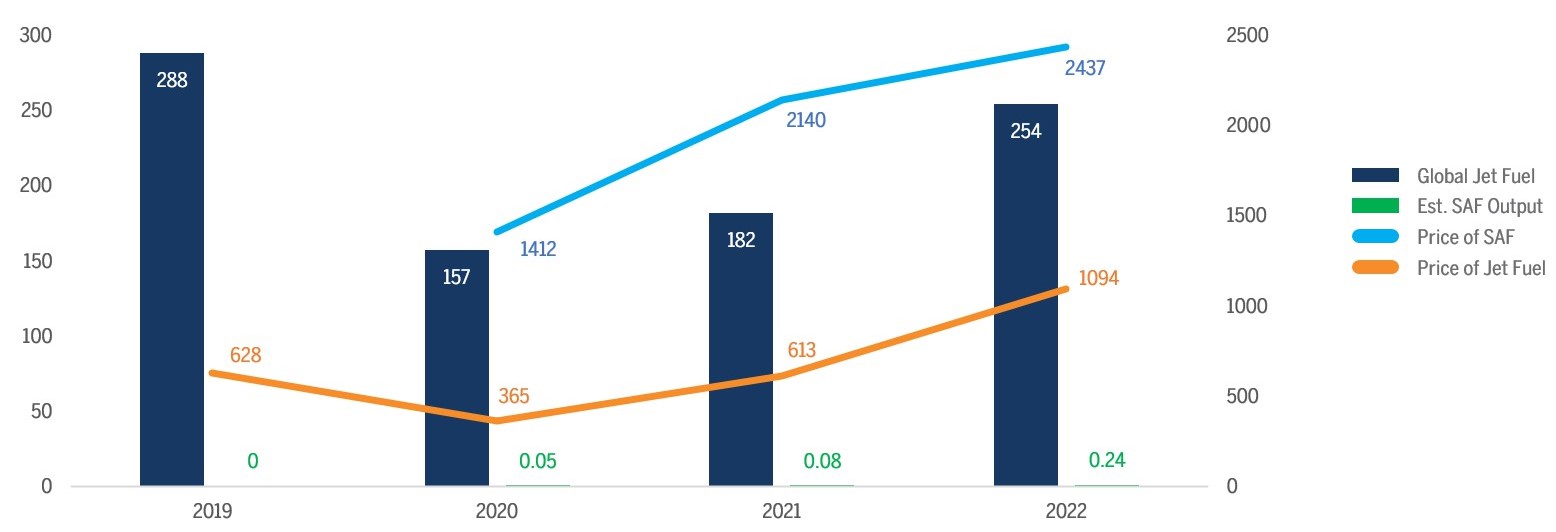

SAF is the most impactful initiative for achieving net-zero emissions in aviation, with the potential to drive over half of decarbonization efforts. SAF can reduce lifecycle carbon emissions by up to 80% compared to traditional jet fuel.13 However, its supply and financial feasibility vary due to mandates, subsidies, higher pricing (2-6 times more costly vs jet fuel), sourcing methods, voluntary commitments, and customer willingness to pay.

Some countries have introduced minimum SAF blending mandates, and several airlines aim to use SAF for 10-30% of their total jet fuel by 2030, making up about 5% of expected aviation fuel demand in that year.14 Today, SAF can be blended up to 50% with traditional fuels and used in existing airport infrastructure, engines, and planes. All GE Aerospace engines and CFM engines (created from the joint venture with GE Aerospace and Safran) can operate on approved SAF, up to 50% “drop-in” SAF, and will be compatible with 100% SAF “drop in” once approved for commercial use.15 However, despite its potential, SAF usage is projected to be around 0.54% in 2024, with availability a huge challenge, as airlines struggle with a lack of infrastructure and supply to meet demands.16 Increasing regulatory mandates (e.g., Europe’s requirement of 2% SAF by 2025, 6% by 2030, 20% by 2035, and 70% by 2050) as well as lowering costs, should be key to driving future adoption and overcoming these barriers.17

Importantly, not all SAFs are created equally. SAFs have varying costs depending on the production pathway, subsidies, and varying levels of quality. Additionally, SAFs may exhibit varying sustainability attributes. This is due to the potential negative environmental impacts associated with feedstock production and high energy demands of certain production processes. Hydrotreated Esters and Fatty Acids (HEFA), which accounts for more than 95% of all SAFs , has high operational but low capital costs, needing incentives to reduce expenses.18 Other methods such as Alcohol-to-Jet and Fischer-Tropsch processes with solid waste require high initial investment but benefit from lower feedstock costs and may come with the benefit of lower carbon intensity.

FIG 3: SUSTAINABLE AVIATION FUEL OUTPUT INCREASES, BUT VOLUMES STILL LOW

This represents the most recent data available.

Source: © International Air Transport Association, 2019, Chart of the Week. All Rights Reserved. Available on IATA Economics page, as of 09/01/2023; https://www.iata.org/en/iata-repository/publications/economic-reports/sustainable-aviation-fuel-output-increases-but-volumes-still-low/

Operational Improvements & Infrastructure

Since 1990, operational efficiencies have led to a 55% improvement in fuel burn per passenger km.19 Measures include weight reduction, aerodynamic improvements in in-service aircraft, and efficiency systems during aircraft operation. Replacing older, less efficient aircraft with today’s more efficient options will typically reduce the average emissions per seat mile by approximately 15% on an aircraft-by-aircraft basis.20 The additional energy consumed in manufacture is many times less than the benefits of flight efficiency. Further infrastructure improvements involve optimizing air traffic management and energy savings at airports.

We consider the manufacturing process important too, but this is not the crux of the opportunity. Sustainable products can be made with responsible materials (no hazardous or non-renewable resources), produced in an ethical way (low environmental impact and ethical labor), have an efficient life cycle (small carbon footprint) and/or be disposed of with minimal impact and waste.

Innovative technologies

Hydrogen propulsion involves using hydrogen to power turbofans, which is straightforward but faces challenges with onboard hydrogen storage and fuel cell power density. While SAF-driven gas turbines will remain the solution for long-range flights, hydrogen power offers more potential for shorter-range segments.

Fully electric aircraft, powered by electric motors using batteries or fuel cells, will emit zero CO2 during operation. However, the current limitations of battery technology, primarily low energy density, restrict full electric power to small aircraft and hybrid power to small-to-medium aircraft. Without significant technological breakthroughs, electric propulsion is expected to comprise only about 2% of aviation energy use by 2050.21

Hybrid-electric aircraft, which combine combustion and electric engines, will use both for maximum thrust during take-off while reducing the use of combustion engines during cruise and descent. Hybrid-electric aircraft with newly designed airframes, such as the Blended Wing Body, are projected to achieve up to 40% CO2 reductions.22 Small hybrid-electric aircraft with 15-20 seats are anticipated to enter service this decade, with regional aircraft following in the 2030s and potentially larger models by 2040.23

Investment Implications

The Aerospace industry, renowned for its technological innovation, has the potential to significantly contribute to sustainable technologies and global decarbonization. As customer demand for energy-efficient and environmentally friendly products intensifies, advancing innovation in sustainable technology will provide aerospace companies with a competitive edge over those not offering sustainable products. Companies that embed decarbonization into their business strategies can reduce costs associated with incoming regulations and rising fuel prices, while also seizing emerging opportunities in a sector driven by fuel efficiency and light weighting. Given the long lead times for many of these investments, it is crucial for companies across the value chain to act promptly to secure a competitive position for the future, aligning with our long-term investment philosophy.

SAFs emerge as a promising near-term solution, capable of substantially lowering lifecycle carbon emissions. However, their broad adoption depends on regulatory support, economic feasibility, and market acceptance. In the interim, operational improvements and infrastructure upgrades can deliver immediate efficiency gains, while groundbreaking technologies like electric and hydrogen propulsion hold the promise of long-term transformation. We believe achieving sustainable aviation will necessitate industry-wide collaboration, continuous innovation, and strategic investments. By navigating these avenues, investors can not only contribute to global climate goals but also capitalize on the emerging market dynamics of a greener aviation future.

Lara Wigan

Equity Research Analyst

*CO2 emitted per passenger and per travelled kilometer.

1. Source: Our World in Data, as of 04/08/2024; https://ourworldindata.org/global-aviation-emissions

2. Source: Inequality in Transport, Who Travels Air?, accessed 01/15/2024; https://inequalityintransport.org.uk/exploring-transport-inequality/who-travels-air

3. Source: IBM, accessed 11/28/2024; https://www.ibm.com/topics/decarbonization

4. Source: © International Air Transport Association, 2019. Our Commitment to Fly Net Zero by 2050. All Rights Reserved. Available on IATA Economics page; as of 10/04/2021; accessed 15/01/2025; https://www.iata.org/en/programs/sustainability/flynetzero/ ; and ICAO, as of 10/05/21, accessed 15/01/2025; https://www.icao.int/Newsroom/Pages/ICAO-welcomes-new-netzero-2050-air-industry-commitment.aspx

5.Source: ICAO, Future of Aviation, accessed 01/15/2025; https://www.icao.int/Meetings/FutureOfAviation/Pages/default.aspx

6. Source: © International Air Transport Association, 2019. p. 3, Global Outlook for Air Transport – Deep Change. All Rights Reserved. Available on IATA Economics page; accessed 01/15/2025; https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport-june-2024-report/

7. Source: CFM Aero Engines, accessed 01/15/2025; https://www.cfmaeroengines.com/sustainability/

8. Jevons Paradox suggests that efficiency improvements can sometimes lead to increased consumption rather than the intended conservation.

9. Source: IEA, Aviation, Energy, as of 11/07/2023, accessed 01/15/2025; https://www.iea.org/energy-system/transport/aviation

10. Source: IEA, Aviation, Energy, as of 11/07/2023, accessed 01/15/2025; https://www.iea.org/energy-system/transport/aviation

11. Source: McKinsey & Company, Decarbonizing aviation: Executing on net-zero goals, as of 06/16/2024; https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/decarbonizing-aviation-executing-on-net-zero-goals

12. Source: CFM Aero Engines, accessed 01/15/2025; https://www.cfmaeroengines.com/sustainability/

13. Source: Source: © International Air Transport Association, 2019. Net zero 2050: sustainable aviation fuels. All Rights Reserved. Available on IATA Economics page; accessed 01/15/2025; https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet-sustainable-aviation-fuels/

14. Source: © International Air Transport Association, 2019. Fact Sheet: EU and US policy approaches to advance SAF production. All Rights Reserved. Available on IATA Economics page; as of 2021, accessed 01/15/2025; https://www.iata.org/contentassets/d13875e9ed784f75bac90f000760e998/fact-sheet---us-and-eu-saf-policies.pdf

15. Drop in means it can be directly substituted for fossil-based jet fuel without any modifications to engines and aircraft.

16. Source: © International Air Transport Association, 2019. Press Release. All Rights Reserved. Available on IATA Economics page; as of 06/02/2024, accessed 01/15/2025; https://www.iata.org/en/pressroom/2024-releases/2024-06-02-03/.

17. Source: International Trade Administration, European Union Aerospace and Defense Sustainable Aviation Fuel Regulation, as of 02/08/2024; https://www.trade.gov/market-Intelligence/european-union-aerospace-and-defense-sustainable-aviation-fuel-regulation

18. Source: SKRYNRG, accessed 01/15/2025; https://skynrg.com/sustainable-aviation-fuel/technology-basics/#:~:text=Note%20that%20the%20fact%20that,process%20of%20getting%20ASTM%20certification.

19. Source: © International Air Transport Association, 2019. Net zero 2050: new aircraft. All Rights Reserved. Available on IATA Economics page; accessed 01/15/2025; https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet-netzero-operations-infrastructure/

20. Source: © International Air Transport Association, 2019. Net zero 2050: new aircraft. All Rights Reserved. Available on IATA Economics page; accessed 01/15/2025; https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet-new-aircraft-technology/

21. Source: Aviation Transition Strategy, MAKING NET-ZERO AVIATION POSSIBLE, p. 16, as of 07/2024, accessed 01/15/2025; https://3stepsolutions.s3-accelerate.amazonaws.com/assets/custom/010856/downloads/Making-Net-Zero-Aviation-possible.pdf

22. Source: © International Air Transport Association, 2019. Net zero 2050: new aircraft. All Rights Reserved. Available on IATA Economics page; accessed 01/15/2025; https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet-new-aircraft-technology/

23. Source: © International Air Transport Association, 2019. Net zero 2050: new aircraft. All Rights Reserved. Available on IATA Economics page; accessed 01/15/2025; https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet-new-aircraft-technology/

Disclosures

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or issuers mentioned. It should not be assumed that investments in such securities or issuers have been or will be profitable. References to specific securities or issuers are to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data.

Sustainable investment considerations are one of multiple informational inputs into the investment process, alongside data on traditional financial factors, and so are not the sole driver of decision-making. Sustainable investment analysis may not be performed for every holding in the strategy. Sustainable investment considerations that are material will vary by investment style, sector/industry, market trends and client objectives. Certain strategies seek to identify companies we believe may be desirable based on our analysis of sustainable investment related risks and opportunities, but investors may differ in their views. As a result, these strategies may invest in companies that do not reflect the beliefs and values of any particular investor. Certain strategies may also invest in companies that would otherwise be excluded from other funds that focus on sustainable investment risks. Security selection will be impacted by the combined focus on sustainable investment research assessments and fundamental research assessments including the return forecasts. Certain strategies incorporate data from third parties in their research process but do not make investment decisions based on third-party data alone.