The end of the calendar year is always a good time to reflect—about the past and what it might mean and about the future and what our best path forward might be. The work we do with our clients is a year-round process, and the end of the year is a good time to look broadly at long-term goals and reassess how changes in the world or in our daily lives impact priorities or adjust the way we feel about advancing our plans.

Of particular concern are the tragic conflicts waging across the globe—in Israel, Gaza and across the Middle East; in Ukraine; and in China, Taiwan and across the South China Sea—where there has been horrible and tragic loss of human life, compromised personal security and significant tension about the future. While these conflicts may be far from home, they give rise to feelings of deep cultural divides that may exist in our own communities. We are keenly aware of our clients’ disquiet over these matters and are here to help clients who want to examine how they can help make a difference.

This year, our letter will focus on some of our clients’ big-picture questions, such as:

- Have our priorities changed or shifted in ways that may alter our current strategic plans?

- How do I/we:

- help make our family’s relationships stronger and more resilient?

- pass on core principles?

- achieve our goals for our financial, human, intellectual and social capital?

- Should we modify existing plans considering changing market conditions?

- How do we achieve goals for family capital, considering pending changes in the estate tax laws and, for families with geographically dispersed members, taking into account cross-border legal and tax considerations?

- How should business owners prepare for the transition of ownership and management to younger generations?

READINESS PLANNING: When we talk to clients about the eventual transfer of their personal or business assets, they often want to focus on preparing those that follow them for the burden and responsibility of caring for those assets. Frequently, they are as interested in passing on their core values and creating a shared vision as they are in maximizing wealth transfers. This can manifest as dialogue between parents and kids, business owners and new management teams or families and charitable beneficiaries.

We believe that readiness planning must start with good communication. Within a family context, it can be valuable for the heads of the family to articulate their near- and long-term goals and to identify experiences that have shaped their views and philosophies so that future generations better understand why they are upholding certain principles and values. Accompanying this discussion, we encourage families to develop comprehensive financial plans that include robust “capital sufficiency analysis” (i.e., do we have enough) to ensure alignment between the tangible and the more intangible elements of the family’s overarching goals.

In this regard, we often work with families, especially younger families facing these questions for the first time, who have little or no existing structure for thinking about these issues. For those families just embarking on a planning journey, we generally advise them to start with a small set of “boundary-setting” financial decisions, such as how much to set aside each year for retirement accounts, education funds and/or charitable contributions. Ultimately, bringing the family together around the creation of a family mission statement and strategic plan may help create a common purpose and culture and allow for consideration of a broad set of constituencies, extending beyond the immediate family members.

CHANGING MARKET CONDITIONS: This year, clients will have an opportunity to revisit existing plans that were developed during a long era of low interest rates, negligible inflation and lofty asset valuations. Now that some of those core conditions have changed, it may make sense to modify some plans accordingly, to maximize low-risk yield on investment portfolios, to explore strategic elections for corporate executives to enhance wealth accumulation plans and to consider intergenerational transfers in advance of pending tax law changes.

For example, declining valuations in certain sectors may suggest taking action to lock in those lower values for income and gift tax purposes. This could take the form of an early exercise of stock options granted to employees in high-growth businesses, or it could lead a client to use their lifetime gift tax exemption to transfer depressed assets (such as commercial real estate) to dynasty trusts for their family, thereby protecting all future appreciation from wealth transfer taxes indefinitely. Strategies that worked well as ways to defer income taxes or take advantage of volatility in the markets can be replaced by strategies that focus on lowering income taxes and minimizing the use of transfer tax exemptions—both are highly effective as part of a long-term plan. The key here is flexibility and a constant review and revision of plans to meet changing conditions.

THE GREAT WEALTH TRANSFER

The “Boomer” generation (those born between 1946 and 1964) currently controls some $68 trillion1 in personal and business assets that they will transfer to their heirs and beneficiaries over the next decade or so. What does this “great wealth transfer” mean for our clients and their descendants?

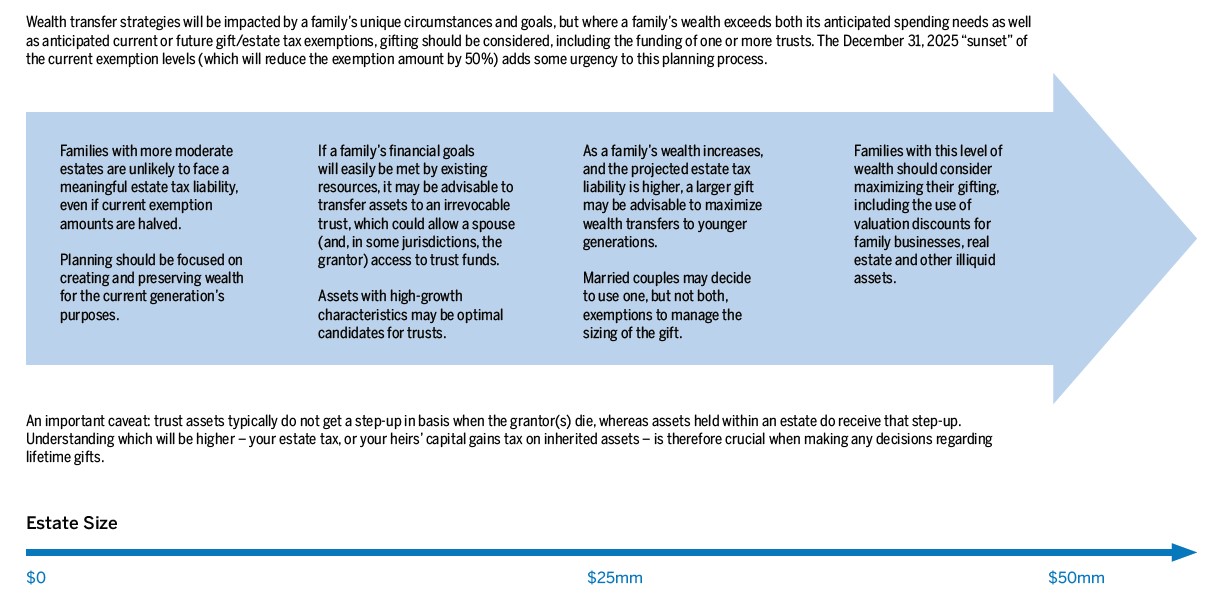

Estate Planning: One important issue involves how to plan around the current augmented estate and gift tax exemption ($10 million indexed for inflation, or twice that amount for a married couple). Adjusted for inflation, a married couple currently may give away up to $25.84 million (or leave that amount to their heirs) without gift or estate tax liability, but under current law, that limit will be reduced by half at the end of 2025. Many families will want to take advantage of the current exemption levels with meaningful gifts, but there are trade-offs, including giving up a stepped-up tax basis at death and the irrevocability of the transfer, so these decisions need to be undertaken with careful deliberation. Because such gifting often involves trusts, family business entities and other complex structures, discussions and planning should begin during 2024—well in advance of the “sunset” deadline. A framework for this planning is contained in the chart below.

PLANNING FOR GIFTS AHEAD OF THE 12/31/2025 “SUNSET”

Depending on the size of the estate, families may want to consider a variety of strategies for maximizing the value of current estate tax exemptions—which are at historically high levels today but may revert to lower levels when certain tax laws expire.

Source: Brown Advisory

Of course, other factors besides the size of one’s estate can be equally or more important when evaluating estate planning steps. In addition, the increasing geographic dispersion of our clients’ family members and their assets across multiple jurisdictions is an important planning factor, as residency and domicile typically have a profound impact on taxation, requiring a holistic economic and tax lens, factoring in all relevant jurisdictions' economic outlooks, taxing rights and rates. This is why we place so much emphasis on the ongoing “discovery” phase of our work with clients—the value of our advice is directly proportional to how well we know them.

Business Transition Planning: Millions of private U.S. businesses will likely transition leadership, ownership, and control to new blood over the next decade or so, representing a potential aggregate value of multiple trillions of dollars. As business owners prepare for these important transitions, they should consider a planning process that incorporates both desired business and financial outcomes and personal outcomes for them and their families. Accordingly, we encourage such business owners to spend time on their personal, family and legacy goals and try to clarify what they are really looking for after the transaction. This step is often ignored, and the result can be a financially rewarding transaction that nonetheless leaves the seller in a situation that doesn’t align with their broader personal goals beyond the business.

It may seem like every year in the recent past has brought with it additional complexity, uncertainty and chaos, but this only serves to reinforce the importance of strategic planning. The better we understand a risk—whether that risk is rising interest rates, political instability or a family wealth transition—the more likely it is that we can turn it into an opportunity, and the easier it is to identify wise methods to navigate and even thrive under those challenging conditions.

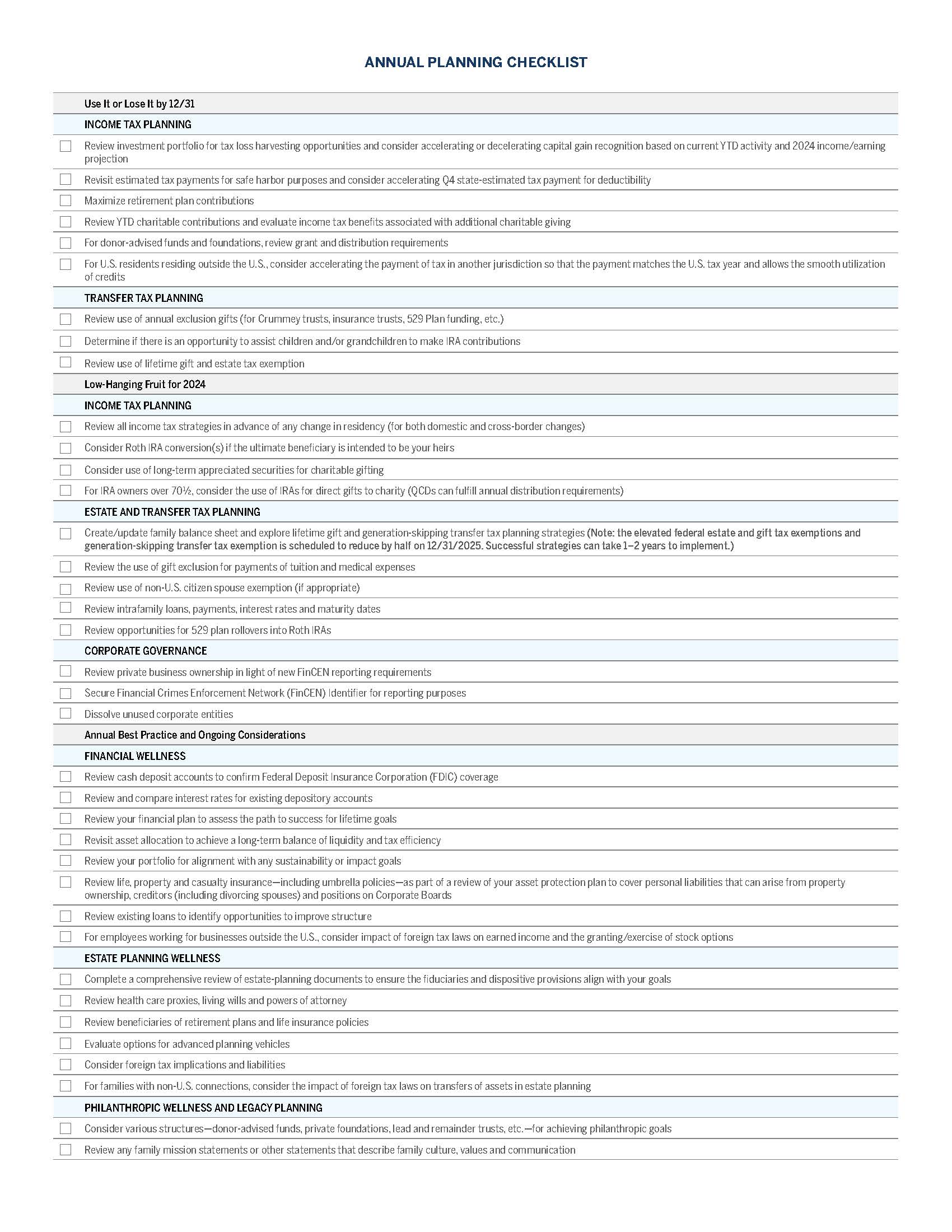

As in prior years, we have provided a high-level checklist that covers many of the most common questions and issues that we plan to tackle with clients this year; this list is always supplemented by the distinct and specific challenges that each of our clients brings to the table from their often-complicated lives. We look forward to discussing these matters with you—as well as any other topics you deem important—in the weeks ahead. ![]()

To download a copy of the checklist, please click here.

1Coldwell Banker. (2019). A Look at Wealth 2019: Millennial Millionaires.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.