Social factors such as housing affordability and demographic data have never been more relevant in the mortgage markets. Over the past few years, rapidly rising home prices coincided with one of the sharpest increases in mortgage financing rates in recent history, resulting in one of the most unaffordable housing markets in the nation’s history. The brunt of this impact has been felt by lower-income homebuyers, many of whom were left out of the home equity gains amassed during this period and have found themselves increasingly disadvantaged by unattainable mortgages. From an investment standpoint, rising and increasingly unpredictable rates have made mortgage securities much more difficult to model and analyze, making every incremental piece of insight all the more important.

Integrating measures of affordability and demographic data into our investment process not only enhances our understanding of the factors affecting the performance of our underlying mortgage investments, but it also allows us to specifically target which communities we support through our capital allocation.

The New Normal

It is difficult for investors and individuals alike not to have been directly impacted by the rapid rise in inflation in 2021 and 2022, the succeeding interest rate hikes by global central banks and the ensuing effects these economic events have had on financial markets, including the mortgage market. The 30-year fixed mortgage rate in the U.S. more than doubled in 2022, climbing from 3.27% on 12/30/21 to 6.66% on 12/29/22 according to the Freddie Mac Primary Mortgage Market Survey (PMMS). This rate environment has led to a drastic decline in affordability for homebuyers. The chart below illustrates this predicament, with home affordability for a typical buyer hitting its lowest point since the start of the index in 1989.

Source: Bloomberg Data as of 4/30/2023 and is the most recent data available.

The problem goes beyond higher mortgage borrowing rates, however. New construction costs have become significantly more expensive due to rising financing and material costs – a direct result of higher rates and inflation, respectively. Additionally, underbuilding in the years following the subprime mortgage and global financial crisis of 2007-2010 resulted in a systemic shortage of housing that has driven rapid appreciation in home prices and rental costs alike. Rising household formations as the millennial generation enters homeownership age only exacerbated these pressures, resulting in fierce demand for a limited supply of affordable homes. Lower income buyers have found themselves priced out of a highly competitive market and unable to amass the ballooning requirement for a down payment for a home. Unfortunately, this has made these potential homebuyers even more exposed to rapidly rising rental costs in recent years, as shown in the chart below.

Source: Bloomberg Data as of 4/30/2023 and is the most recent data available.

A core tenet of our sustainable investment philosophy is that we firmly believe that the most attractive opportunities reside at the intersection where both investors and borrowers mutually benefit from the relationship. We have consistently been drawn to a variety of mortgage securities that support lower-income borrowers and residents, discovering several instances over time that align with our return objectives while also increasing housing access and affordability.

For example, within the Residential Mortgage-Backed Securities (RMBS) sector, Fannie Mae’s and Freddie Mac's labeled social and sustainability programs proactively cater to underserved borrowers, including first-time homebuyers and those who may be cost-burdened, income-challenged, disabled or from minority communities. Fannie Mae’s HomeReady program and Freddie Mac’s Home Possible program both further address cost barriers through lower down payment requirements and increased flexibility for borrowers. These programs provide the most appealing financing relative to borrowers’ credit profiles. As a result, cashflows backed by these pools are generally much more predictable and may make them more enticing for investors given the increased certainty of repayment timing. While mortgages typically have higher prepayment rates when rates are falling, periods where investors least prefer to receive their capital back sooner, the appeal of RMBS backed by these programs to investors is they are less likely to seek alternative financing in these periods. This typically results in more stable prepayment profiles over the life of these securities.

In the Commercial MBS (CMBS) sector, Freddie Mac's Workforce Housing program helps provide multifamily housing opportunities to residents in the "missing middle," i.e., those who do not qualify as low-income but still face affordability challenges in their local housing market. These individuals often hold essential community roles such as firefighters, police officers, teachers and healthcare workers. The impact of these programs is particularly acute as multifamily housing stock has been shrinking in recent years due to underbuilding. According to the National Multifamily Housing Council’s report published in May 2022, over half of all renters in America spend more than 30% of their income on housing, and the U.S. will require 4.3 million additional apartments by 2035 to meet current rental demand. Given this backdrop, well-managed and affordable multifamily developments not only support local communities but are likely to maintain high occupancy and generate consistent cash flow for the foreseeable future.

While investing in traditional or labeled social bond programs can be more straightforward, an investment process that relied entirely on these programs would likely miss many attractive and high-impact opportunities that are available to investors willing to put in the work to find them. Given that, we use a holistic process that drills into the loan-level data, anonymized and aggregated to protect borrowers’ privacy, to understand the underlying communities we are financing through our investments in mortgage-backed securities. Specifically, we augment our process with a third-party data provider, ICE Sustainable Finance, that provides geospatial data analysis which can help us identify these opportunities. This provider links anonymized borrower data provided by the securities we invest in with publicly available datasets, helping us to characterize the demographics of residents within each census tract by cross-referencing location data with other community-specific details such as physical climate risk exposure, income levels, property values and social vulnerability. Characteristics are summarized into both a physical climate risk score and a social impact score.

The social impact score is especially helpful for analyzing and sourcing MBS outside of the growing, but still limited, labeled bond universe, allowing us to build a more diversified portfolio.

A Better Lens into Borrower Behavior

Investing in mortgages is challenging due to the unique feature of mortgages in that they typically can be paid off (prepaid) at any time by the borrower without penalty. This subjects investors like us to reinvestment risk if rates fall and we are required to reinvest at the now lower market rates. Unfortunately, but not unsurprisingly, borrowers tend to refinance their homes and prepay their mortgages more often when interest rates fall, creating a dynamic that investors get their principal returned at exactly the inopportune moment, when prevailing rates are low. Lower-income borrowers typically have lower mortgage balances as a result of less expensive homes and stricter debt-to-income restrictions put in place by lenders. These smaller-balance mortgages can be attractive during periods when rates change significantly, as prepayment activity doesn't fluctuate as drastically for these mortgages at inopportune moments for investors. This is a simple math issue—refinancing a $100,000 mortgage will lower the monthly payment by a much smaller amount than refinancing a $1,000,000 jumbo mortgage, while the fixed costs of refinancing will be relatively much more burdensome for the $100,000 mortgage than for the $1,000,000 mortgage. As a result, performance for pools of small balance mortgages such as these can tend to have more consistent investment performance over time.

Since the timing of repayment on mortgage-backed securities relies in part on the behavior of the underlying borrowers, our understanding of these borrowers allows us to better predict and model their behavior into our analysis of the securities and the portfolios that hold these securities. As an example, if a large number of borrowers unexpectedly repay their mortgages early, a portfolio is likely to shorten in duration when interest rates are decreasing. We believe understanding social factors, such as housing affordability and demographic factors can be highly informative for understanding how borrowers may respond to swiftly changing economic conditions, and an analysis that includes these factors helps us to better manage the duration and risk of our portfolios and avoid surprises.

We believe that by identifying mortgages related to underserved and high-need communities, both investors and borrowers’ benefit. For the same reason that a smaller mortgage tends to have more stable performance than a jumbo mortgage, lower-income borrowers can tend to have more consistent repayment behavior when it comes to refinancing. Meanwhile, low-income borrowers have been particularly affected by higher rates, and as sustainable investors, we seek to invest in mortgages that will support these borrowers and be held long term. In recent years, rapid appreciation in real estate has intensified wealth inequality, making this issue even more pressing. According to the National Association of Realtors, low-income homeowners comprised just 27% of all homeowners in 2020, down from 38% in 2010. High-income homeowners reaped more than 70% of the $8.2 trillion increase in the value of U.S. owner-occupied housing from 2010 to 2020, while low-income owners benefited from just 3% of that increase—a situation that is not only unfair to that demographic but potentially detrimental to the mortgage market in the long run.

In short, integrating housing affordability and demographic factors into our analysis gives us a deeper understanding of the borrowers backing the mortgages we are investing in, which enables us to better forecast the prepayment behavior of our loan portfolio and invest in well-established programs backed by the government that do not have credit risk corresponding to the underlying borrowers.

Geospatial Loan Level Approach

While mortgage-backed securities provide substantial loan level information to investors, that information has remained relatively stable over the years while the availability of outside data sets continuously improves. We believe we can refine our investment analysis and further distinguish our approach by going beyond the details provided in deal documents, and complementing them with geographic, climate and demographic data sourced from the communities where borrowers live. This process allows us to more comprehensively evaluate not only specific investment opportunities, but also the overall environmental and social outcomes of the investment portfolios we manage.

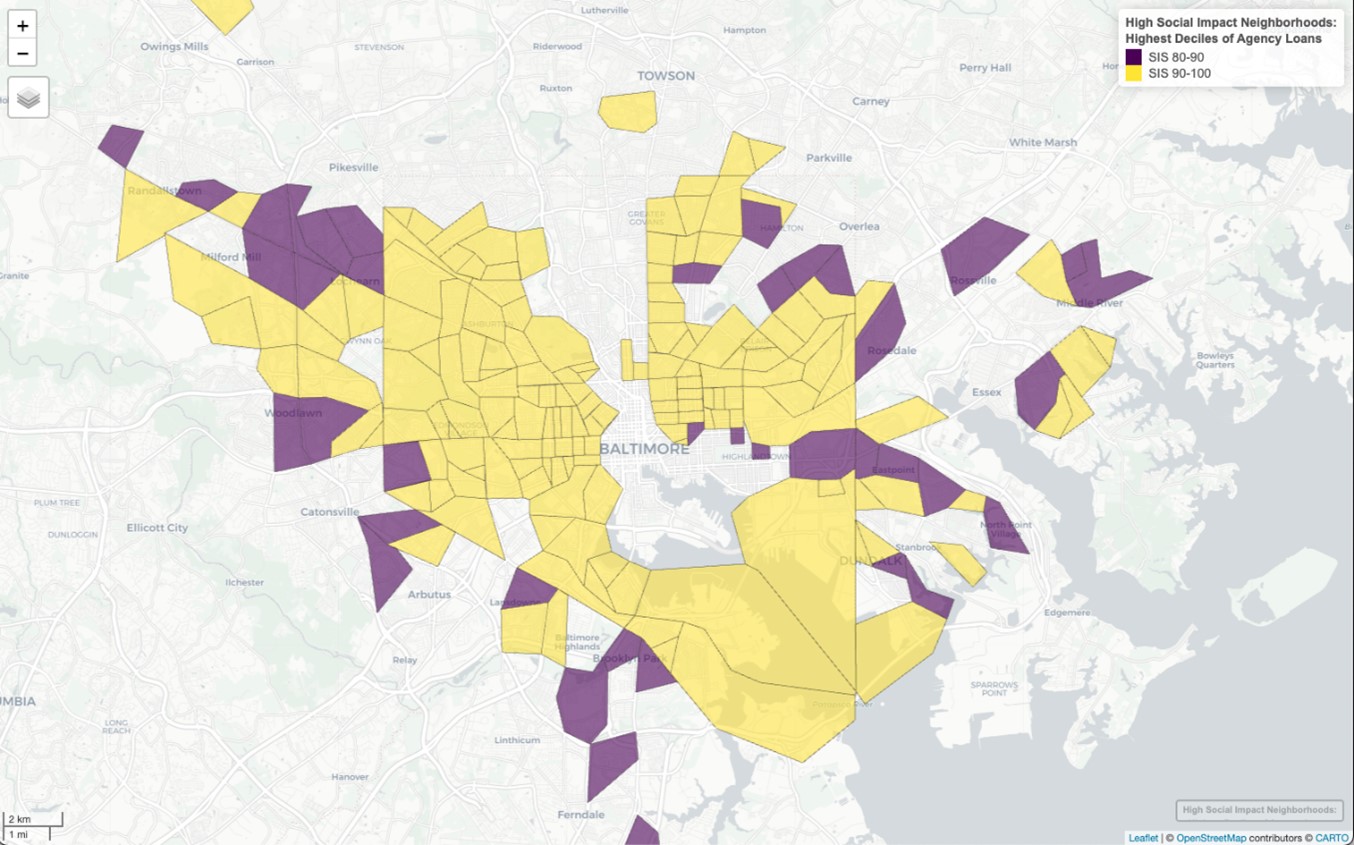

Using all of the tools at our disposal, we are able to target our mortgage investments toward communities likely to have the highest social need. As an example, the map below shows the city of Baltimore's various census tracts, with the yellow and purple shading indicating areas with higher social impact scores where investment may have the greatest positive outcomes on the community. At a high level, our analysis is based around the goal of identifying and evaluating investable mortgage pools for their overlap with similar neighborhood characteristics to those highlighted in the map. While personal privacy concerns prevent us from conducting our analysis below the census tract level, the work done by ICE Sustainable Finance provides significant information around the broader community that does give us a unique perspective into the communities and borrowers we are supporting through our investments.

Source: ICE Sustainable Finance data as of 06/2023.

In conclusion, we believe integrating housing affordability and demographic factors into our evaluation of mortgage-backed securities allows us to gain clearer insight into the communities in which underlying borrowers live, better manage risk, and provide much needed financing to underserved communities. We believe our data-driven and differentiated process based on loan level data and external data sets puts us in a unique position to navigate the uncertain markets.

Disclosures

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results.

The information provided in this material is not intended to be and should not be considered a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only and is not individually tailored for or directed to any particular client or prospective client.

Bloomberg is a trademark/service mark of Bloomberg Finance L.P., a Delaware limited partnership.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated monthly. It is included in the S&P CoreLogic Case-Shiller Home Price Index Series, which seeks to measure changes in the total value of all existing single-family housing stock.

US Zillow Rent Index (ZORI): A smoothed measure of the typical observed market rate rent across a given region. ZORI is a repeat rent index that is weighted to the rental housing stock to ensure representativeness across the entire market, not just those homes currently listed for rent. The index is dollar-denominated by computing the mean of listed rents that fall into the 40th to 60th percentile range for all homes and apartments in a given region, which is once again weighted to reflect the rental housing stock.

Freddie Mac Primary Mortgage Survey Rate: Each week, since April 1971, Freddie Mac surveys lenders on the rates and points for their most popular 30-year fixed-rate, 15-year fixed-rate and 5/1 hybrid amortizing adjustable-rate mortgage products. The survey is based on first-lien prime conventional conforming home purchase mortgages with a loan-to-value of 80%. In addition, the adjustable-rate mortgage (ARM) products are indexed to U.S. Treasury yields, and lenders are asked for both the initial coupon rate and points as well as the margin on the ARM products. There is a mix of lender types surveyed each week—credit unions, commercial banks and mortgage lending companies—that is roughly proportional to the level of mortgage business that each type commands nationwide.

The National Association of Realtors (NAR) Housing Affordability Fixed Mortgage Index measures whether a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.