The market's path forward is extremely uncertain right now, but there are still planning steps that investors can implement today to generate positive results down the line. Tax loss harvesting (the process of realizing a loss on the sale of an asset, in order to mitigate taxes on subsequent capital gains) is one of those planning steps. We have been talking with an increasing number of clients about this topic recently, and wanted to share some basic concepts related to tax loss harvesting. Note that any decision to harvest losses is highly dependent on factors specific to your situation, and should only be made after consultation with tax and investment advisors.

TAX LOSS HARVESTING: WHAT IS IT?

“Tax loss harvesting” is the strategic sale of assets that have declined in price, for the purpose of realizing capital losses; these losses can be used to offset capital gains you may have realized in order to reduce your tax liability. Various IRS rules apply to this practice, with the most notable being the "wash sale" rule that requires investors to remain divested of a loss asset (or one that is substantially similar) for 30 days in order to recognize the loss for tax purposes.

TAX LOSS HARVESTING: KEY TAKEAWAYS

- Offsetting realized capital gains with realized capital losses can meaningfully reduce or eliminate a client’s tax liability in any given year.

- Lower tax liabilities as the result of tax loss harvesting increase the amount of money available for reinvestment each year; as such, the practice can generate value over time in the form of compound growth.

- If unused, capital losses can be carried forward to future tax years and used to offset future capital gains.

- Assets should not be sold solely for tax reasons. Instead, assets should be sold strategically in order to maximize overall asset allocation and diversification goals.

TAX LOSS HARVESTING 101

“Tax loss harvesting” allows a tax-paying investor to offset realized capital gains with realized capital losses to reduce or eliminate tax liabilities. Wash sale rules apply as noted above. Realized losses that exceed gains can be carried forward to future tax years until fully utilized.

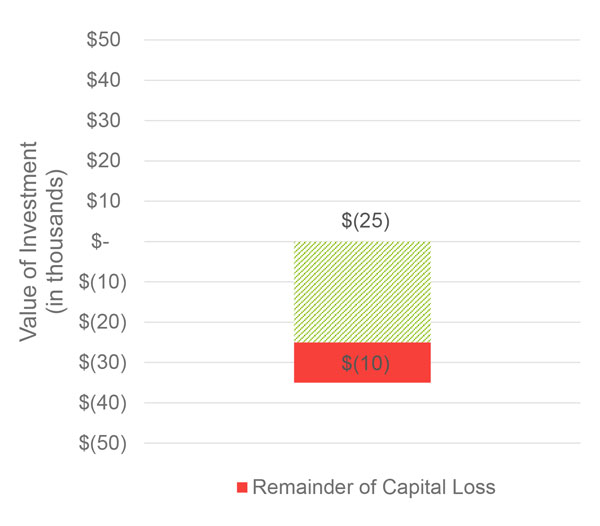

Applying the Capital Gain to the Capital Loss

This chart depicts a hypothetical scenario in which a married couple sold one asset for a gain of $25,000 and another investment at a loss of $35,000.

The realized capital gain was subject to a potential tax rate of 23.8%, or $5,950. By using tax loss harvesting, the capital gains tax of $5,950 was avoided.

After offsetting the $25,000 gain, the couple still has a $10,000 capital loss available to them. They can use that loss as follows:

- The IRS allows a reduction of income up to $3,000 for married couples per year.

- The remaining $7,000 can be recognized as a long-term loss which can be carried forward to future tax years.

The graph shown above represents hypothetical investments and is not representative of an actual client's portfolio. This information is provided for illustrative purposes and is not intended to be a recommendation or suggestion to engage in or refrain from a particular investment strategy. Actual results will vary. Please see the end of this presentation for important information. Source: Brown Advisory analysis.

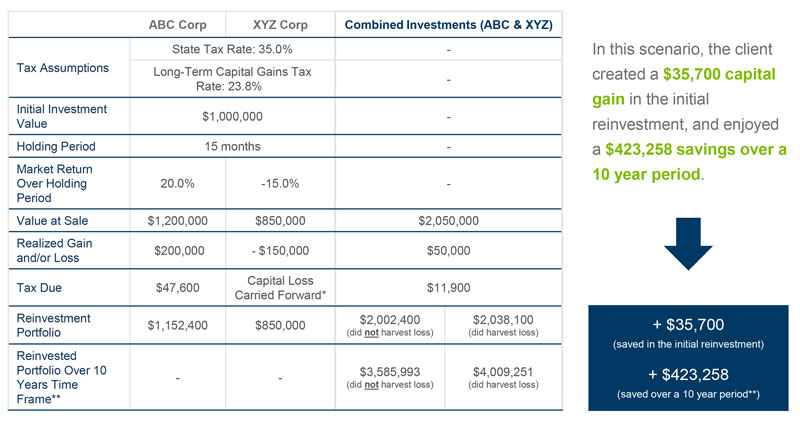

BENEFITS OF TAX LOSS HARVESTING OVER THE LONG TERM

By employing tax loss harvesting strategies, investors can reduce their tax liability and therefore have more money available each year for reinvestment. Over time, this practice can produce meaningful value via the power of compounding returns.

*It is important to note that the taxes listed for Investment in XYZ are not applied because the loss is carried forward. ** Assuming that the benefit of tax loss harvesting is consistently applied to create a return differential of 1%. This example assumes an average return of 7% for the tax-efficient portfolio and 6% for less tax efficient portfolio.The table shown above represents hypothetical investments and is not representative of an actual client's portfolio. This information is provided for illustrative purposes and is not intended to be a recommendation or suggestion to engage in or refrain from a particular investment strategy. Actual results will vary. Please see the end of this presentation for important information. Source: Brown Advisory analysis.

BENEFITS OF TAX LOSS HARVESTING OVER THE LONG TERM

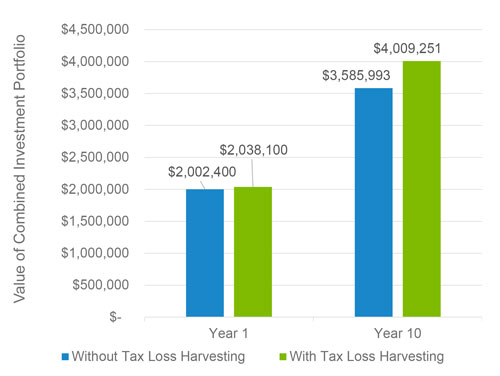

Although the savings from tax loss harvesting may appear to be minor at first, over time it can add meaningful value to a portfolio.

The graph shown above represents hypothetical investments and is not representative of an actual client's portfolio. This information is provided for illustrative purposes and is not intended to be a recommendation or suggestion to engage in or refrain from a particular investment strategy. Actual results will vary. Please see the end of this presentation for important information. Source: Brown Advisory analysis.

This chart depicts the two scenarios described above--the blue bar depicts results without tax loss harvesting, and the green bar shows results with loss harvesting. The single instance of harvesting resulted in the portfolio growing by an additional 1% per year over a 10-year period, all else being equal.

Hopefully this brief introduction to tax loss harvesting is helpful, and serves as a reminder that one can use these kinds of techniques to mitigate the negative consequences of a down market or an investment that loses value. As noted previously, investors should always discuss any tax-related strategy with their investment and tax advisors before taking any action.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.