With the daily stream of “7th inning” and “fourth quarter” articles about the current economic cycle, it is hard to avoid warnings in the media about the potential for a downturn and/or recession. There are some warning signs, to be sure, such as an inverted yield curve, tight labor markets, and a slowing housing market, but there are also other factors—such as modest household leverage, low corporate default rates and accommodating monetary policy—that suggest the economy may still have some room to run.

While we can’t predict the near-term direction of the economy or of markets, there is no denying that safe haven assets are back in vogue, and investors have been voting with their dollars. Many investors are fleeing to cash or equivalent investments like ultrashort bond funds, but such investments are not as effective as longer-term Treasuries at mitigating losses in an equity market downturn. We submit that mortgage-backed securities offer an attractive combination of ballast against a potential stock-market reversal, and current income during the months and/or years before such a contraction might occur.

INCOME VS. STABILITY

An inverted yield curve is making shorter-duration investments attractive for investors. On June 6, 2019 the 30-day Treasury yield was 2.36%, vs. the 2.12% offered by 10-year U.S. Treasuries. As a result, investors have been flocking to short-term bond funds at a staggering pace; these funds have seen inflows of more than $150 billion since the beginning of 2017, and more than $50 billion just in the first four months of 2019.

This sets up a natural tension for those thinking about a turn in the cycle; while limited-duration bonds generally offer a yield advantage over a more traditional (i.e., intermediate and longer-term) allocation to U.S. Treasuries, investors also desire the stability and diversification that a longer Treasury portfolio can provide. To prepare for a potential equity market dislocation, investors generally seek assets with low or negative correlation with equities—this partly insulates them during a drop in the stock market, and afterward can give them a logical source of capital to take advantage of depressed equity valuations.

Downside Protection From Fixed Income

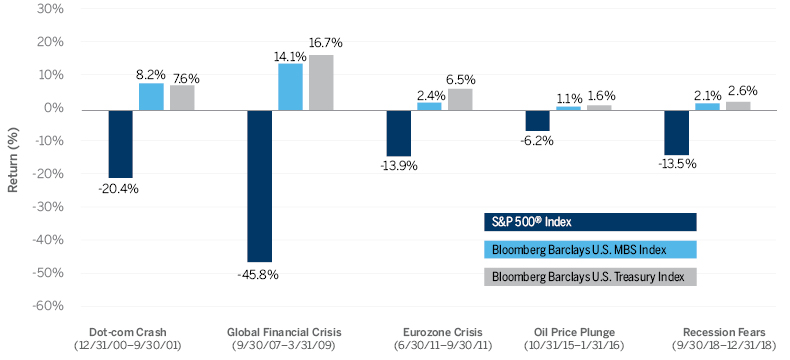

During major stock market corrections in this century, Treasuries served as a powerful counteragent to stock-market losses in balanced portfolios. Mortgage-backed securities offer a different risk profile than Treasuries, to be sure, but the sector offered similar downside protection during these time periods.

MBS and Treasury Performance During Recent Equity Downturns

(12/31/2000-12/31/2018)

Source: Bloomberg. Please see the end of the article for a complete list of index definitions.

Investors that are limited to U.S. Treasuries, by policy or mindset, face a tradeoff today—longer-term Treasuries can offer defensive benefits if the stock market drops, but typically require a sacrifice in income vs. shorter-term bonds. However, we believe that there is an alternative that combines these diversification and income benefits, in the form of Aaa-rated mortgage-backed securities (MBS) that are guaranteed by U.S. government agencies or other government-sponsored entities (GSEs). These securities typically have a risk profile similar to U.S. Treasuries, but currently offer a higher level of income potential due to the variable timing of cash flows as borrowers repay their mortgages. Moreover, MBS investments have offered similar diversification benefits to U.S. Treasuries, as shown in the chart above; for example, during the global financial crisis (specifically, from 9/30/07 to 3/31/09), the mortgage sector returned 14.1%, just slightly behind Treasuries which returned 16.7%.

Of course, the additional income available in the MBS sector is not a free lunch—it comes with its own set of challenges. Uncertain timing of cash flows is the largest factor influencing agency MBS returns, because each homeowner has the right to refinance or prepay their mortgage at any time (thus depriving the mortgage-holder of an anticipated income stream). MBS investors should therefore have a solid understanding about the individual characteristics of loans in their portfolios. Each homeowner has unique economic drivers: interest rate, amount borrowed, size of down payment, credit score and location are just a few of the factors that vary widely from borrower to borrower. These factors drive prepayment, as well as the potential for impairment (if a meaningful subset of borrowers in a pool suffer a default).

For some investors, this complexity represents an impassable barrier to entry, but we believe that our process helps us effectively manage the prepayment risk embedded in the asset class. In our work on our MBS strategy, we spend a great deal of energy on prepayment dynamics, with an integrated top-down perspective on borrower rates and home price appreciation coupled with the individual borrower factors mentioned previously. If we are successful in this research, we give ourselves the opportunity to generate incremental income vs. the broader fixed income market, without adding a commensurate risk of impairment.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

The S&P 500® or Standard & Poor’s 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The Bloomberg Barclays U.S. Mortgage Backed Securities (MBS) Index tracks the performance of U.S. fixed-rate agency mortgage backed pass-through securities. The Bloomberg Barclays U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

Standard & Poor’s, S&P, and S&P 500 are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc. Bloomberg Barclays Indices are trademarks of Bloomberg or its licensors, including Barclays Bank PLC.

BLOOMBERG, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS,BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG BONDTRADER, BLOOMBERG TELEVISION, BLOOMBERG RADIO, BLOOMBERG PRESS, BLOOMBERG.COM and BLOOMBERG LAW are trademarks and service marks of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries.