Every year, college gets more expensive. Picking the right savings strategy can be the key to accomplishing your family’s personal goals.

For many parents, paying for college is the largest expense/investment they will ever face within a concentrated period of time. U.S. News reports that the average cost of tuition and fees at private U.S. colleges exceeds $35,000 per year in 2019, with costs at many schools closer to $50,000. That figure does not include room and board. And there is little relief in sight: According to the College Board, private college tuition in the U.S. has risen steadily by more than 4% per year for the past 30 years—on an inflation-adjusted basis, private college is more than twice as expensive today as it was in 1988.

Looming costs like these merit proactive planning. In addition to preparing for the expense itself, many parents may want to consider other family goals, such as transferring wealth to their children for more flexible use. In this article, we discuss four common savings vehicles—UTMAs, 529 Plans, Crummey trusts and 2503(c) trusts—and look at the strengths and weaknesses of each.

Not All Plans are Equal

The best college savings plans maximize every saved dollar by providing tax benefits and opportunities for long-term growth. Each savings plan offers unique tradeoffs, benefits, and drawbacks, making each one a potentially strong choice for families, depending on their specific circumstances and goals. Understanding how these vehicles function is extremely important as families try to balance competing considerations such as taxation, lifetime gifting goals, and financial aid in their college savings strategies.

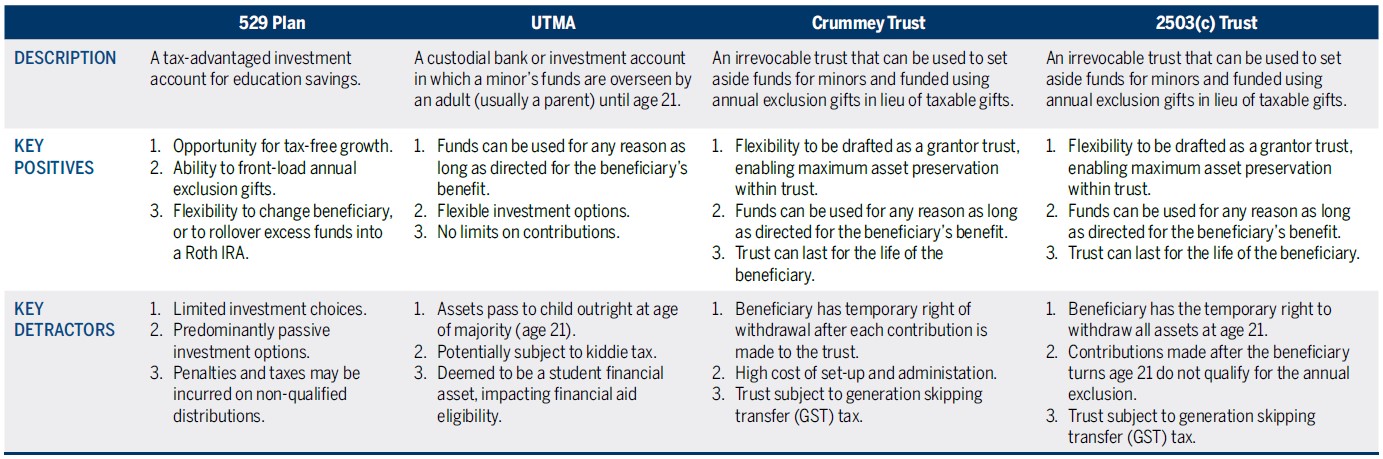

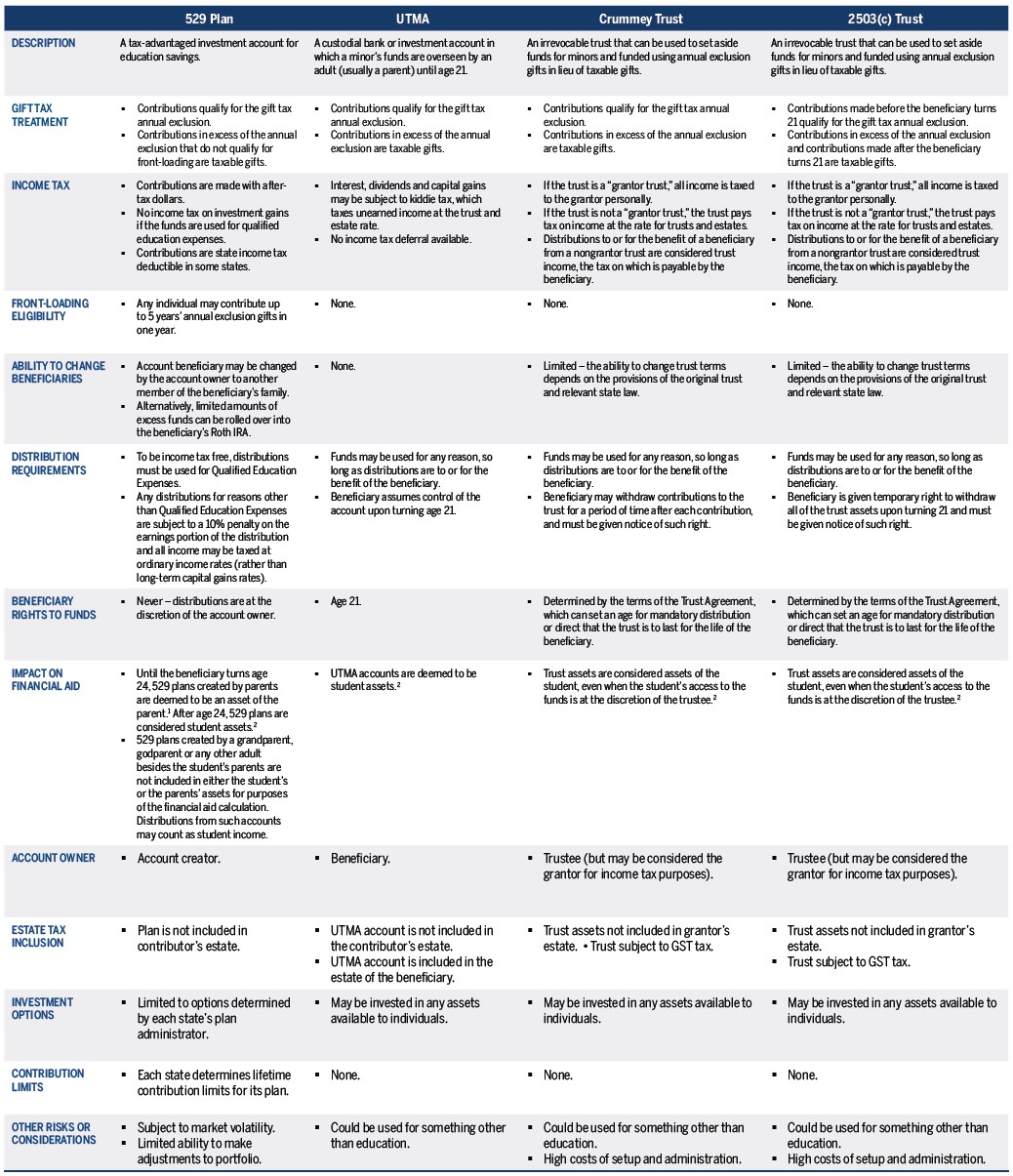

The tables below (the first table is simply a summarized version of the longer table at the end of the article) compare 529 plans, UTMAs, Crummey trusts and 2503(c) trusts. We have outlined the pros and cons of each of these vehicle options, as well as key features such as income tax treatment, gift tax treatment, distribution rules, ownership characteristics and impact on financial aid.

COLLEGE SAVINGS VEHICLES: A SUMMARY

Source: Brown Advisory analysis. A more comprehensive table is found at the end of the article.

529s and Crummey Trusts Shine Among Options

When weighing all of the features of these plans, we believe that 529 plans are an ideal choice for parents saving for college expenses. 529 plans have three distinct features which are particularly compelling: 1) 529 plan assets grow tax-free; 2) the assets are treated preferentially with regard to financial aid calculations; and 3) 529s let parents “front-load” annual exclusion gifts (in other words, they can contribute up to five years of annual exclusion gifts in one tax year). This last feature is especially beneficial as it lets families transfer assets more quickly into a vehicle offering tax-free growth.

A Crummey trust offers several key benefits to parents seeking to transfer wealth to their children for more flexible lifelong use. Crummey trusts allow assets to accumulate within the trust structure throughout the beneficiary’s lifetime (i.e., assets can be used to pay for college or be left to accumulate for later use). Further, Crummey trusts offer a great deal of flexibility—investment choices are not limited to a fund menu as with 529 plans, and there are no limits on annual contributions. Finally, these trusts can be set up as grantor trusts, meaning that taxes on trust income can be paid by the grantor and do not need to be paid by the trust (which would cut into growth over time).

Importantly, 529 plans and Crummey trusts are not mutually exclusive. Families can use both options to maximize tax-free growth for college expenses while also creating a path toward long-term financial stability for children.

Conclusion

What is the best vehicle for your family? This is an important question that cannot really be answered by simply reviewing a table. Every family is different and seeks to accomplish different long-term goals with its financial plans. In working with our clients, we find that college savings plans are often a first step toward developing broader plans for passing wealth to children, grandchildren or other younger family members. The discussion about college planning can therefore act as a springboard for comprehensive conversations—with both parents and children—about legacy objectives, financial values, asset protection and charitable giving. All of these topics are worthy of in-depth discussions with trusted advisors.

1When a school calculates a student’s Expected Family Contribution, only a maximum of 5.64% of parental assets are counted, so for every $10,000 of eligible parental savings (including 529 plans), $564 is expected to be contributed to tuition.

2A maximum of 20% of a student’s assets is considered available for tuition, so for every $10,000 of eligible student savings (including UTMA accounts), $2,000 is expected to be contributed to tuition.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.