You Can Now Use 529s for K-12 Costs—But Should You?

The cost of college is growing at an astronomical rate, and Section 529 plans have long helped individuals and families grow assets earmarked for education in a tax-efficient manner.

The 2018 tax overhaul expanded the reach of 529 plans beyond college. As of this year, Federal law lets you distribute up to $10,000 each year from your 529 plan to fund primary (K-12) education tuition. But should you? Here are a few wrinkles to consider.

Your state may see things differently than the IRS.

The first thing to consider is that 529 plans are governed at the state level. States vary widely in how they conform to federal tax law governing 529s—in other words, the IRS may not tax a distribution for K-12 tuition, but your state might.

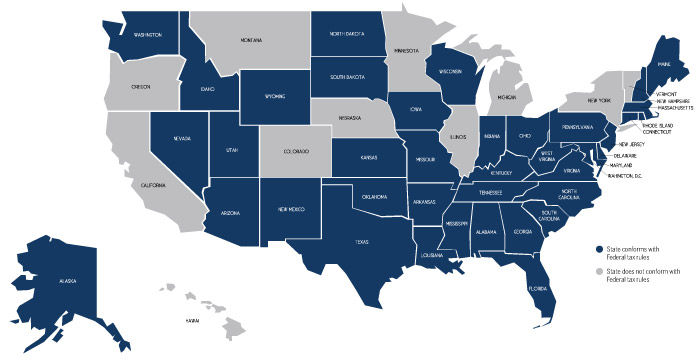

As it stands today, 31 states1 conform to the federal tax code on 529 plans (see graphic). These states either exempt K-12 distributions from state taxes up to the $10,000 limit, or do not impose any state income tax (in which case the issue is not relevant).

If you reside in one of the other 19 states, you should review the current rules in your state AND look at whether your state is considering a change. Some states impose state taxes and/or penalties on any withdrawals for K-12 tuition. In some cases, states allows current-year deductions for contributions into the 529, but a subset of those states are looking at rolling back those deductions if assets are ultimately used to fund K-12 education. The situation may be further complicated if you live in one state but invest in a 529 plan in another state.

529 Plans and K-12 Expenses: A State-By-State Breakdown

Source: Brown Advisory. 1https://www.savingforcollege.com/article/529-savings-plans-and-private-school-tuition#sfc-page-anchor-2

K-12 expenses will likely occur much sooner for you than college expenses. That impacts your investment equation.

Remember that 529 plans and other tax-deferred growth vehicles are most effective over longer periods of time, so that you can (potentially) benefit from the compounding effect of tax-free growth over many years. Over shorter periods, there is less of a compounding effect to compensate you for the sacrifice of liquidity that comes with a tax-deferred vehicle.

One specific point to consider: If you built your 529 asset allocation with a long-term target in mind (for example, 18 years from your child’s birth), it may be invested for long-term growth with a relatively heavy allocation to equities. If you decide now to use the plan to fund elementary education, those expenses may kick in for you just a few years after you’ve opened your 529. In that case, your initial long-term allocation may no longer be appropriate for your adjusted short-term time horizon. So if you are interesting in using 529 assets for K-12 education, it is worth reviewing your investment selections to ensure the account’s allocation is in alignment with your new goals.

Participation in a 529 plan impacts financial aid eligibility.

Lastly, 529s can impact financial aid eligibility, so whether you are deciding how much to contribute, when to withdraw, or even whether to have a 529 in your name, it is important to consider the impacts on the financial aid calculation.

The FAFSA application (Free Application for Federal Student Aid) combines several factors to calculate your Expected Financial Contribution (“EFC”), or the amount your family is deemed financially able to pay toward education. One key factor is who “owns” financial assets—up to 5.64% of non-retirement parent assets are deemed “available” for college costs, compared with up to 20% of student assets. Parent-owned 529 plans are typically counted as investment assets of the parents for the EFC calculation, so they are actually more favorable in this regard than student-owned assets such as UTMAs. The EFC calculation can also influence whether a grandparent should create their own 529 plan, or make contributions to a parent-owned plan instead.

Even if you have substantial wealth and financial aid is not a consideration for you, many states provide additional benefits for 529 assets, including scholarship provisions and creditor protection. Depending on your circumstances, there may be many reasons to keep 529 assets in place until college.

As is often the case when tax law changes, just because a new option is available does not mean it is always advisable. The new flexibility for using 529 plans to fund K-12 expenses is certainly worth considering, but as always you should consult with qualified advisors to ensure you are looking at the bigger picture.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or asset classes mentioned. It should not be assumed that investments in such securities or asset classes have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client. Any business or tax discussion contained in this communication is not intended as a thorough, in-depth analysis of specific issues.