Since the election in November 2016, investors have been watching for signs of how tax reform might proceed under the Trump administration. Reform is likely to affect the taxes they will pay on income and capital gains, and may influence the progress of their underlying investments.

Buck Chapoton, a strategic advisor in our Washington, D.C. office, is a valuable resource for us when major changes to the tax code are under consideration. As assistant secretary for tax policy under President Reagan, Buck was one of the chief architects of the tax reform effort that culminated in the landmark Tax Reform Act of 1986. In this conversation, Buck offers historical perspective on the Reagan tax reform initiative and what that experience may tell us about the current effort to overhaul the tax code.

Buck, you have a unique perspective on present-day tax reform discussions, given your experience with the Reagan administration’s tax reform effort in the 1980s. How would you compare the environment for tax reform then versus now?

I would say that there are some similarities but a lot of differences. The new administration doesn’t really have a full-fledged policy proposal yet, but the skeleton it has put forward is a huge tax cut, not tax reform. To be clear, the difference is that true, healthy tax reform is designed to neither raise nor lower revenues, but instead to adjust the code to be more fair and simple. It’s important to remember that the Reagan administration also began its effort with a very large tax cut in 1981, then, to everyone’s surprise, took on true reform four years later.

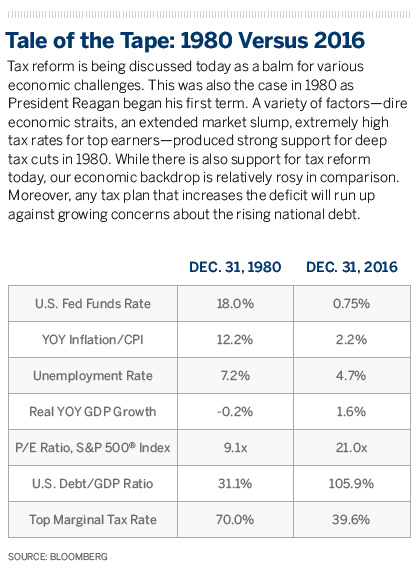

But the environment in the 1980s was quite different than what we see today. For one thing, the state of the economy was far worse then. Reagan’s election was largely about the hope that he could re-energize the U.S. economy, which as many of us remember was a real mess after a decade of high inflation, sky-high interest rates, weak economic growth and high unemployment. Everyone felt the need for big changes to right the ship—taxes were a major factor, and, if you recall, we were also going through a period of extremely tight monetary policy to rein in inflation. People have concerns about the economy today, but it’s nothing like what we faced in 1981. Second, the state of politics was very different—we were able to achieve our tax cut goals in 1981, as well as our reform goals later, with a lot of bipartisan cooperation, whereas today, Washington has become incredibly polarized, as we all know.

Finally, the tax code itself was quite different. It was in some ways much simpler than today, but the big problem was simply that rates were extremely high—the highest individual rate was 70% in 1980. Many on both sides of the aisle were ready to drastically cut taxes when we arrived in Washington as a way to jolt the economy back to life. People today also want to see taxes reduced. In particular, there seems to be a broader understanding that our corporate tax regime, with its high rates relative to other countries and its taxation on any worldwide income repatriated back home, is no longer competitive on the world stage. Smaller companies are particularly disadvantaged by our corporate rates, as those firms do not have international income that they can keep outside of the U.S. like larger global firms do. But I do not perceive the same sense of urgency regarding interest rates or the economy that we faced back then, and I think it’s unlikely that we’ll see rate cuts of the magnitude that Reagan and his team implemented in their 1981 tax legislation.

You mentioned tackling both tax cuts and tax reform during the Reagan years. Can you walk through the various pieces of tax legislation from that era and talk about what each was seeking to achieve?

Well, we basically named the tax packages based on what our goals were—I guess we weren’t very creative with the names! In 1981, we passed the Economic Recovery Tax Act (ERTA), and that was the objective—to pump new life into the economy after a decade stuck in the mud. In addition to lowering tax rates dramatically at every income level, ERTA enacted generous business tax provisions, such as accelerated depreciation schedules and reinstatement of the investment tax credit, which greatly incentivized new investment in plant and equipment in the U.S. This legislation was unequivocally a tax cut, with virtually zero reform, but it was a “fair” tax cut that provided a benefit to everyone. Some individuals and corporations benefited more than others, but no entity was paying more in taxes after ERTA than it was beforehand.

Historians can debate how effective ERTA was in spurring economic recovery, but to the extent it accomplished its goals, it did so through heavy deficit spending. So we moved on to what I think of as “corrective legislation,” and this was in fact the Reagan team’s first foray into reforming the tax code. These were appropriately titled the Tax Equity and Fiscal Responsibility Act (TEFRA) of 1982 and the Deficit Reduction Act (DEFRA) of 1984. Both sought to tighten the tax code without raising rates. One thing that was different then versus now was that the president was comfortable with increasing tax revenue, if we could accomplish it through closing loopholes and eliminating tax-avoidance mechanisms.

And the goals of the Tax Reform Act (TRA) of 1986?

Our goal with the TRA was truly one of reform, and we were able to build on our experiences earlier in the administration to both refine our reform goals and develop a plan for crossing the finish line in Congress. We felt that the tax code had evolved over time— including some of the changes we had put in place—to a point where it was, pure and simple, big government action designed to influence business and investment decisions in a major way. For example, we had lowered taxes on capital during Reagan’s first term—lowering capital gains taxes and accelerating depreciation— but this did not benefit service companies, which had minimal capital investment and were still paying high tax rates. So with the TRA, we wanted to broaden the tax base as much as possible and reduce preferences that had developed over many years that favored one segment of the economy over another. To the extent that these steps increased revenue, we would lower all tax rates as much as possible to keep the overall bill revenue-neutral.

In practical terms, this meant unwinding many of the benefits we had established in ERTA in 1981. But in return for losing those benefits, individual taxpayers—and, to a lesser extent, corporate taxpayers—received further reduction in their tax rates. The legislation, like all tax packages, had its flaws, but I believe it was successful in moving the needle in the right direction in terms of getting tax policy out of the way of the U.S. economy. I think that’s an important distinction—I didn’t say get “tax” out of the way, I said “tax policy.” The goal of the TRA was not tax reduction— in the end, we wanted to minimize the number of times someone making a business investment decision would be swayed heavily by tax considerations.

The Trump administration has begun its efforts to pass tax legislation. What are your thoughts on the administration’s initial blueprint?

As I said earlier, the blueprint that we’ve seen so far falls squarely in the “tax cut” category; it isn’t reform. (It will be interesting to see where it leads with the current Congress, which has already put in work on a revenue-neutral plan to implement broad-scale tax reform.) I’ve attempted to compare our 1981 proposals with the size of the current administration’s tax cut proposals in terms of impact on the deficit as a percentage of gross domestic product. By my calculations, they are similar in scale.

In 1981, we faced close to an economic emergency, and there was real support from both parties to accept deficit spending. Today, the economy may not be in fantastic shape, but things are going reasonably well, with low inflation and low unemployment. And, Republicans and Democrats alike are far less open to deficit expansion than they were 30 years ago. But we are still in the early stages of the tax debate in Washington, and I wouldn’t want to suggest any particular ability to guess how that debate will shake out. The fact is, we can’t predict how major policy matters will be resolved in Washington, and it would be irresponsible to try— especially in the current political environment.

In general, where do you see tax reform heading in the next few years?

I am not optimistic about the prospects for real tax reform anytime soon. That’s a shame; our tax code really needs attention. For one thing, there’s the issue of complexity that many people acknowledge; every year, it seems new rules and procedures are tacked onto the code to address new circumstances or, worse, to achieve government policy objectives through tweaking tax benefits. It’s much harder to pass laws granting direct financial benefits to a particular industry than it is to amend the tax code! For example, imagine trying to enact a law providing a $100 billion-per-year subsidy to encourage homeownership. It would be impossible. Yet that’s essentially what we have today with the mortgage interest deduction (MID). There are thousands of smaller-scale provisions like the MID in the tax code today. The anti-government members of Congress seem to think government interference is OK as long as it’s achieved through tax preferences.

Not only does this create incredible complexity for the average taxpayer, but it creates a code governed by politics rather than sound and fair tax principles. This is a really big problem that I think about a lot. In a system like that, long-term thinking gives way to short-term expediency, and it also opens the door wide for those seeking ways to circumvent rules designed to prevent tax avoidance. For example, a big issue today is that of taxation of international business activities of U.S. companies. I wish we had focused more on this in the 1980s because today we don’t have a consistent principle in place about what’s fair when taxing U.S. companies’ activities abroad. As a result, U.S. companies and their tax advisors have become world-leading experts in how to legally move their profits outside of U.S. tax jurisdiction. Our national debate on this topic has now degraded into one of proposing tax holidays to encourage U.S. companies to repatriate money and, even worse, structuring tax inversion transitions to move future earnings out of U.S. reach, even though management remains happily ensconced in the U.S. The very idea of focusing this debate on principles rather than politically engineered technical rules and quick fixes seems to be a nonstarter.

From my experience, the key ingredients to achieve tax reform are some bipartisan cooperation; a motivation to achieve fairness; effective public education about how taxes can warp business behavior; and finally, a committed president who is truly focused on the policy considerations of a tax reform package. These long-term benefits are not easy to sell politically. I hope I am wrong, but I do not believe that we currently have any of these ingredients in place. I said that during the Obama administration, and I am saying it now during the Trump administration—in my view, no administration in the last 30 years has had anywhere near as much focus on tax reform, or as favorable an environment for reform, as we did during the Reagan years, and unfortunately, I don’t see those conditions changing materially anytime soon.

Given what we know and don’t know about potential revisions to the tax rules, how are you framing this issue for clients today?

First, we think it is, generally speaking, important to advise clients against acting in anticipation of any proposed, but not yet enacted, tax provision. All we have from the administration is a short list of topics it intends to address in tax reform. Its intent to lower tax rates is front and center, but we don’t have answers to many of the most basic questions. Will the administration attempt major, comprehensive tax reform, or will it fall back to a more basic cut in tax rates for businesses and individuals? If it takes the latter path, will it also seek to reduce the hole in the federal budget produced by tax cuts by repealing widely used deductions (such as state taxes) or shutting down major tax loopholes? Or will it simply accept a major increase in the deficit, as Reagan did in 1981? And finally, if it decides that it must try to minimize the deficit gap created by tax cuts, which deductions and special-interest provisions in the tax code will be put on the chopping block? We don’t have any of these answers yet, so it is far too early to be building any kind of detailed tax-planning strategies.

That said, we are working with clients in two ways with regard to tax reform. From a planning standpoint, we are laying the groundwork for possible actions based on some of the tax outcomes that we consider to be most likely. And from an investment standpoint, we are examining the sectors and businesses in which we invest to understand how our various investments may be positively or negatively impacted by the corporate tax cuts currently being discussed.

Regarding the underlying investments in client portfolios, a big factor in the administration’s arguments for tax cuts is their potentially positive impact on corporate growth and profitability. Where do you see tax cuts making the most difference?

Well, it’s interesting that the market already spoke pretty loudly on this point in November and December last year. Many people were surprised to see the market rally after the election, and it was a clear indication that investors anticipated good times ahead for businesses in terms of lower taxes and looser regulation. Some of the biggest beneficiaries of the “Trump rally” were smaller firms with a primarily U.S.-domestic revenue base—these are firms that generally pay their income taxes in full. As the likely time frame for tax legislation has been pushed out, we have seen optimism dissipate somewhat from certain segments of the market.

Our equity research analysts are more focused on being prepared versus having any intention of speculating today on a “tax reform trade.” They are doing a lot of work on this subject, however. They have done a deep dive on how the companies in our coverage universe would be impacted by the various tax provisions that are on the table. And the analysis isn’t simple—every industry and company is potentially affected by taxes differently. Some companies may be better positioned than others based on whether they are net exporters or importers. In other cases, the benefit of taxes may only be temporary if the industry is highly competitive and a boost to profits is likely to evaporate as companies and their competitors use the tax benefits to cut prices.

But essentially, our analysts are holding this knowledge in reserve for the time being. If and when new tax legislation crystallizes, they’ll be ready with a full understanding of how that legislation may impact the companies in which they invest.

And finally, what kinds of tax planning adjustments are you discussing with clients?

First, we are focusing only on areas where we have some confidence about the direction of the tax legislation effort. As we’ve discussed, that is a small patch of territory—there is no legislation yet or even a detailed proposal for legislation. We know taxes aren’t going up in the short term, so we are encouraging clients to accelerate deductions and defer income where it otherwise makes sense to do so. With even a small chance of relief from, or repeal of, gift taxes, we don’t want clients to take actions that would incur gift tax; however, they can still use their exemptions or use many viable strategies—intra-family loans, GRATs and other tools—that don’t incur gift taxes. Specifically, we believe that the Affordable Care Act’s 3.8% surtax on investment income is likely to be repealed— either during the ongoing health care negotiations, or as a result of tax legislation. The repeal of this surtax would effectively reduce capital gains taxes, and thus it may make sense to defer realization of gains in some instances (although investment considerations should generally overrule tax considerations in such decisions).

But remember, the tax discussion is still fluid and highly uncertain, and we need to avoid speculating about future changes in the tax code. In particular, we need to be highly conscious of the effective date of the changes being discussed. Our advice would be very different if a provision were given an immediate effective date vs. being delayed or phased in over several years. Many factors— from policy, to politics, to the pragmatic reality of when legislation is completed—will play into both the content of a tax reform package and the dates when its provisions become effective. We need to be patient and stay informed about how negotiations are proceeding, so we can be prepared to act when more becomes clear.

I know that this “be prepared” answer on planning sounds awfully similar to how our research team is thinking about tax reform. We have different jobs at Brown Advisory, but we tend to agree on fundamental principles. One of those principles is that we don’t make decisions for clients based on speculation. “Patient and prepared” is probably the best way to describe our current stance.

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested. The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

The S&P 500® Index represents the large-cap segment of the U.S. equity markets and consists of approximately 500 leading companies in leading industries of the U.S. economy. Criteria evaluated include market capitalization, financial viability, liquidity, public float, sector representation and corporate structure. An index constituent must also be considered a U.S. company. Standard & Poor’s, S&P, and S&P 500 are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a subsidiary of S&P Global Inc. BLOOMBERG is a trademark/service mark of Bloomberg Finance L.P., a Delaware limited partnership.

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.