Fast Reading

- The economic costs of climate change are rising, reaching $301 billion in 2023, more than doubling from the early 2000s. In response, central banks are widening the scope of their mandates as they acknowledge the risks climate change poses to financial stability.

- We think this has the potential to reshape banks’ business models as central banks use sustainability-linked regulation to sharpen their focus on mitigating climate risks.

- Exploring recent mandatory sustainability reporting for European Banks, we seek to identify the leaders who are best positioned to navigate this regime shift and drive improved financial performance.

Introduction

We might well remember 2024 as a year of escalation. The risks associated with climate change floods, wildfires, droughts, and hurricanes intensified. Natural disasters are not only horrific but also costly, shaking the foundations of economies.1 As these events intensify, the costs spiral.

In 2023 alone, global direct damages from weather related hazards more than doubled, in real terms, from the early 2000s to reach $301 billion.2 Against this backdrop, central banks are widening the scope of their mandates as they acknowledge the risks climate change poses to financial stability. We think this has the potential to reshape banks’ business models via regulated disclosures and as capital requirements begin to incorporate climate factors.

In our research, we seek to uncover sustainable investing opportunities across European banks. Who are the leaders that can effectively navigate this shift? What are the risks of inaction? And how can sustainable financing drive improved financial performance?

When Climate Risk Threatens Financial Stability

Central banks have long been responsible for ensuring economic stability. Traditionally, they set interest rates, control the amount of money in circulation, and supervise the banking sector. Yet, as the destructive effects of climate change become clearer, another factor has started to influence their monetary policy considerations: sustainability.3

Climate risk has the potential to significantly impact financial stability. Severe weather events can have inflationary effects as floods, forest fires, and hurricanes impact price stability around the world.4 Droughts, for instance, tend to exert upward pressure on headline inflation for several years. By integrating climate related risks into their regulatory frameworks, central banks aim to mitigate the potential disruptions to the financial system and promote a more resilient economy.

In 2023, the Bank of England’s climate stress test scenario found that incremental losses could be substantial at more than £200bn if the UK takes “no action” to mitigate climate.5 The ECB estimated credit and market losses could amount to €70bn whilst acknowledging this figure significantly understates the actual risk.6

Both find that unmitigated climate change could translate into the need for the financial sector to run with higher provisions and/or higher capital levels.

In other words, sustainable investing factors have become less theoretical. In response, regulation is evolving from a ‘disclosure’ phase into an ‘implementation’ phase.

Which Climate Risks are Banks Most Vulnerable to?

Credit losses for banks can generally be broken down into two broad categories: transition risks (or the cost of adaption: policy, technology, and customer behavioural changes); and physical risks (such as extreme weather events: floods, hurricanes, and wildfire).

In the residential mortgage market, for example, flooding is one major issue. Mortgage portfolios located in coastal areas or regions prone to natural disasters may suffer considerable damage, leading to reduced rental income and a significant depreciation in property value.7

Why Fixed Income Investors Must Care About Climate Transition Risk in Banks

To reshape investment markets, there are two main approaches for meaningful change: regulation and incentives. We anticipate an emphasis on the former as central banks use sustainability linked regulation to sharpen their focus on mitigating climate risks.8

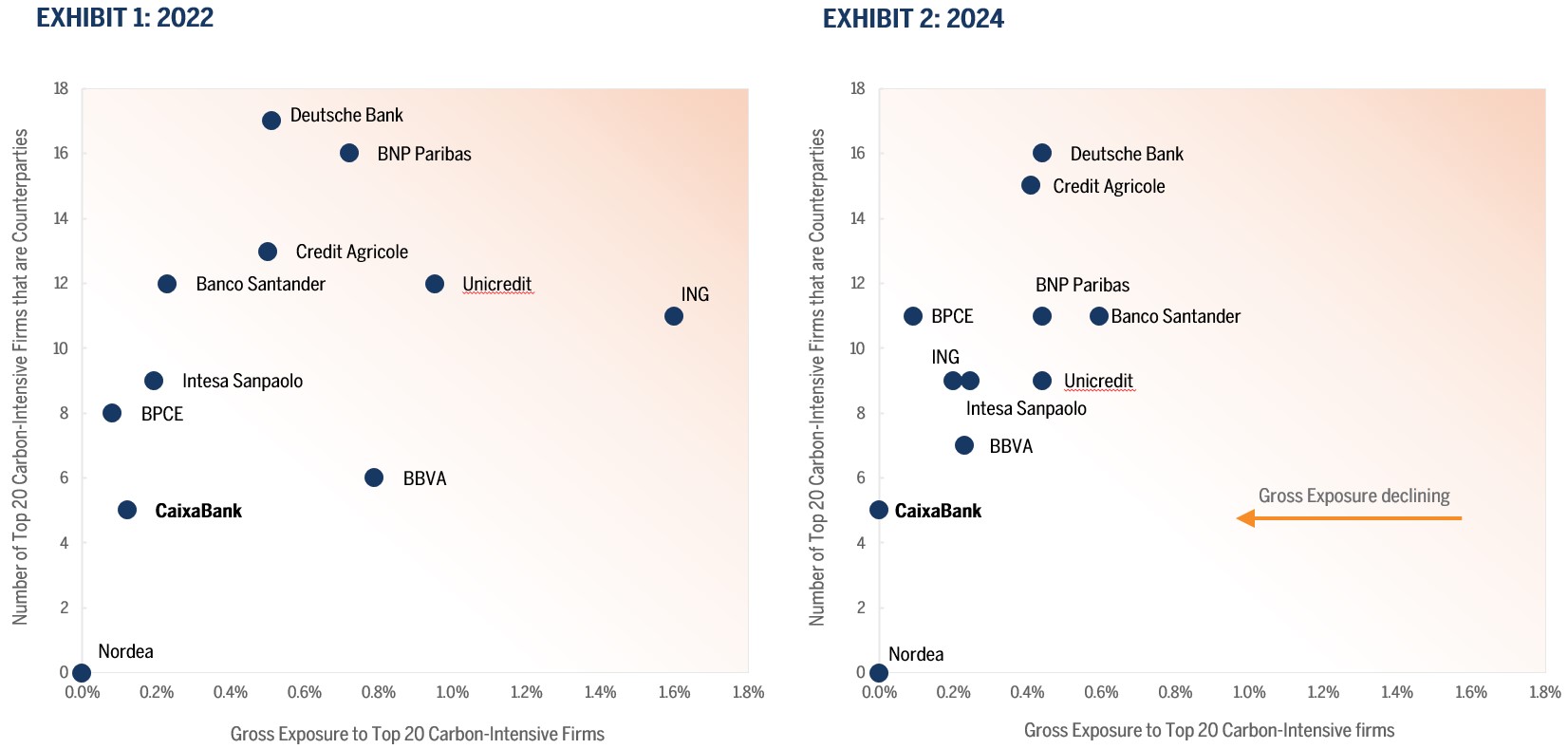

In late 2023, the European Banking Authority (EBA) became the first global regulator to propose for environmental and social risks to be captured in Pillar 1 capital requirements, the minimum capital requirements that banks are required to maintain relative to the credit risk on their balance sheets which aims to ensure banking sector stability. We expect to see this via risk weighted asset inflation and/or increased regulatory requirements. At the end of 2022, the European Union (EU) made disclosure of climate risks relating to transition and physical risks mandatory in Pillar 3 transparency disclosures (the regulated information banks provide on risk management practices such as risk exposures and capital adequacy). Using these disclosures, we find that across a sample of 11 banks, gross exposure to the world’s top 20 polluting firms shrank by 11% between December 2022 to June 2024. This result in a meaningful shift in exposures as highlighted in Exhibit 1 and Exhibit 2.

However, the data comes with a variety of health warnings due to material restatements that are common with this type of information. We agree that investors should be cautious about the reliability of this data.9 Consistency is still a major problem, and definitions vary widely: even a list of the top 20 highest carbon intensive firms varies from bank to bank.

Nevertheless, we continue to believe the banks' disclosures on industry sectoral exposures are the best sources of data versus those that are estimated via third parties. We use this as a key underpinning for our own engagements with financial institutions, believing that increasing transparency supports better investment risk analysis.

Identifying Sustainable Opportunities: CaixaBank

Beyond Pillar 3 disclosures, we take a holistic view of the sustainable risk factors facing banks.

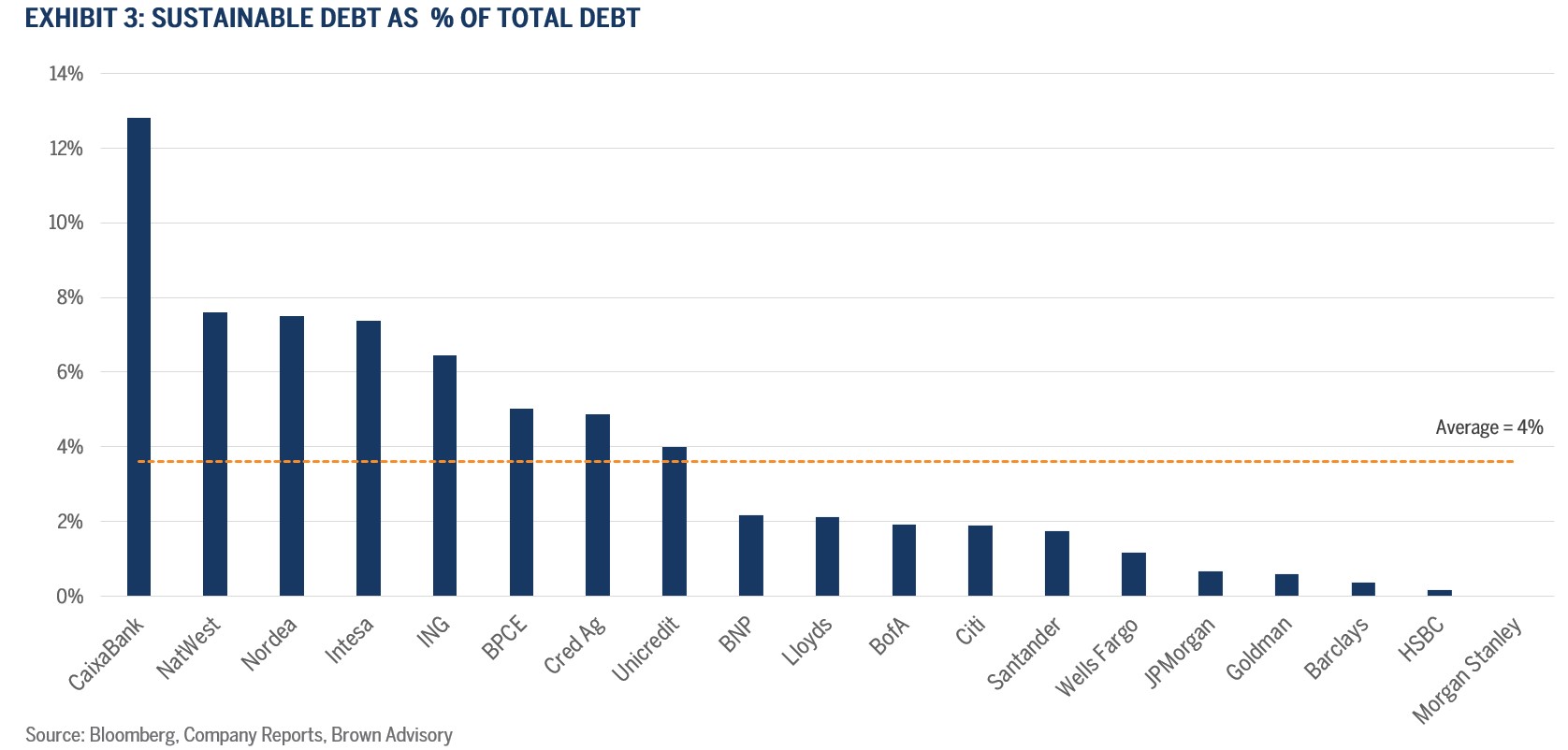

CaixaBank, a Spanish retail bank, stands out as a leader in sustainable finance and successfully embeds practices to manage both transition and physical risks. It is one of the largest green, social, and sustainable debt issuers over the last five years with a total of €11.1bn outstanding as of October 2024 and are a leader in the proportion of labelled debt issuance outstanding as a percentage of their total debt securities. See Exhibit 3.

And where does the money raised by this sustainable debt issuance go? The proceeds are allocated across various qualifying green assets, with a significant emphasis on renewable energies and green properties. Specifically, 70% of the proceeds are directed towards affordable and clean energy (renewable energies), 24% towards green buildings (approximately half of which are residential properties), 5% in water and waste management, and another 5% in clean transport.10 This leadership in sustainable financing, of which the largest allocation is renewable energy, supports Spain’s access to cheap, clean energy, resulting in lower energy prices for consumers and businesses and lower energy price volatility that can strengthen economic performance.

Within the residential property category, CaixaBank is one of Spain’s largest mortgage lenders and thus acutely aware of the physical risks of climate change on their portfolio. The recent, devastating floods in Spain’s Valencia region have brought into sharp focus the risks that natural disasters pose to property portfolios.

CaixaBank is less exposed to this region versus other banks, but the economic cost to the country will be substantial. The bank has designed a variety of innovative sustainable products that seek to incentivize and support customers to either transition to more sustainable business models or adapt to the harshest impacts of climate change. It launched an energy improvement mortgage that requires a minimum 7% increase in energy efficiency for home retrofits. In 2023, 30% of the bank’s total new mortgage origination was for properties with the highest energy efficiency rating (EPC A or B). This too can strengthen CaixaBank’s credit profile. The EU has already established a legislative framework to support decarbonization of building stock by 2050. As a result, banks may become less willing to lend against older, less efficient homes, which will weigh on their valuations. Being ahead of this shift can result in a higher value portfolio and improved long term financial resilience.11

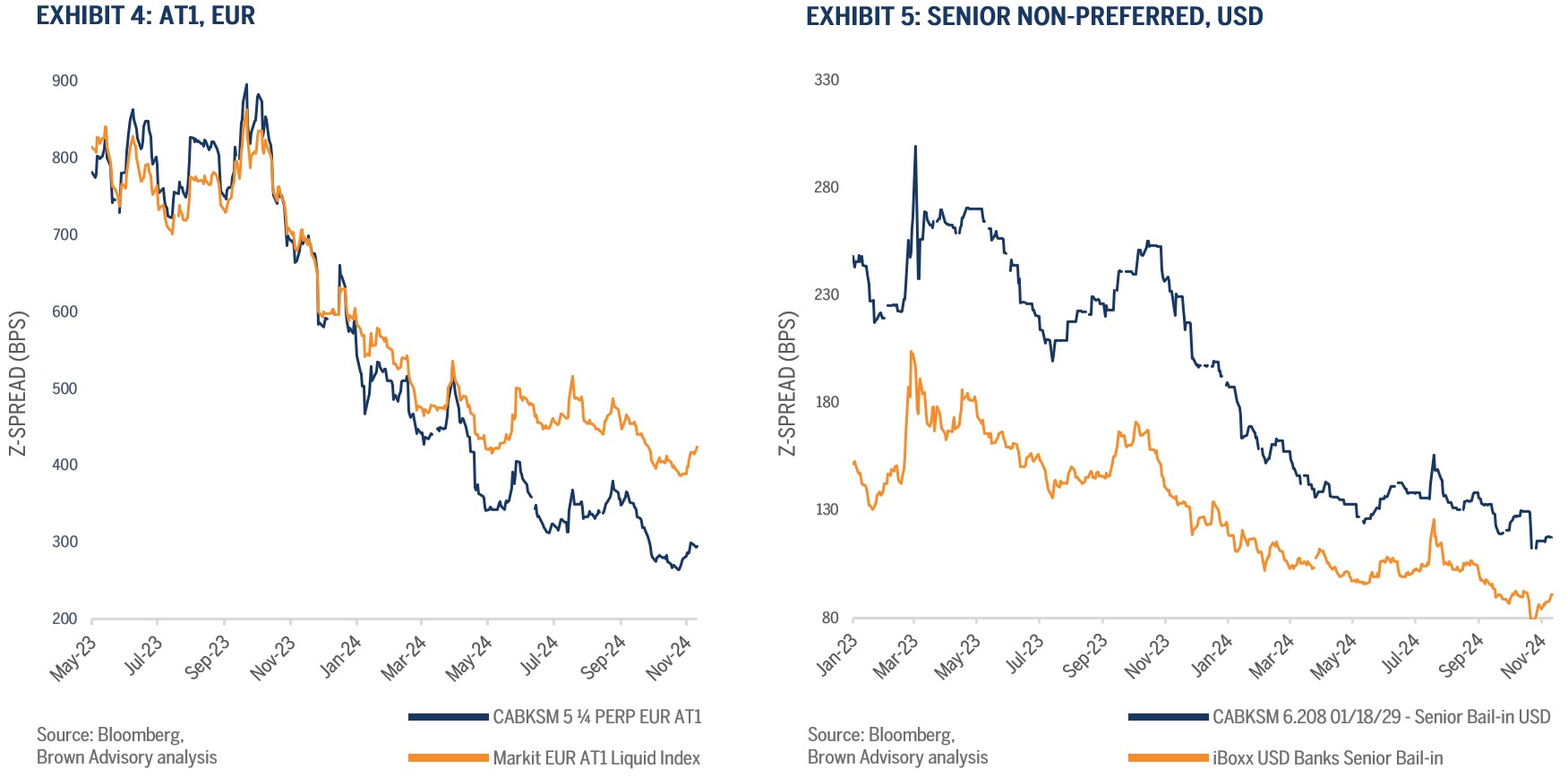

The two charts below illustrate the bond spread performance (here we use the z spread as a measure of the difference in expected rate of return between a bond and the theoretical risk free rate) of two CaixaBank bonds (an additional tier 1 bond and a senior non preferred), a name we hold in the Global Sustainable Total Return Bond Fund. Both show significant spread tightening since purchase. While most of the outperformance is driven by the credit story, including both fundamental and sustainable aspects, it is also important to consider the influence of various factors such as the unique nature of the instrument, its currency, features like call date reset spreads, and multiple bond characteristics.

Conclusion

Regulation in the banking industry is nothing new. Central banks’ primary goals price stability and financial stability remain unchanged. We believe it is important to point out that the disclosure and regulatory landscapes are very different on the other side of the Atlantic, which may result in regulatory arbitrage. We wait to see. Either way, when looking in Europe we find that climate risk is starting to influence financial regulations and in turn reshape banks’ business models in the hope of leading to improved long term financial stability.

Anna Rudgard

Fixed Income Research Analyst

Yacine El-Mohri

Fixed Income Research Analyst

1. Source: Christine Lagarde, FT, as of 11/12/2024; https://www.ft.com/content/ce58587f-4c8a-4655-8926-32fb0e6e0184

2. Source: AJ Gallagher, as of 2023; https://www.ajg.com/gallagherre/-/media/files/gallagher/gallagherre/new…

3. Source: Tribe Impact Capital, as of 11/11/2024 ; https://tribeimpactcapital.com/impact-hub/central-banks-and-sustainable…

4. Source: UN, as of 07/03/2024; https://www.un.org/en/desa/prices-warming-planet-inflationary-effects-c…

5. Source: Bank of England, as of 03/13/2024; https://www.bankofengland.co.uk/prudential-regulation/publication/2023/…

6. Source: European Central Bank, as of 04/18/2024; https://www.ecb.europa.eu/press/blog/date/2024/html/ecb.blog20240418~22…

7. Source: HSBC Global Research, European Banks ESG: Scope 3 is too big to ignore, as of 09/27/2024

8. Source: HSBC Global Research, European Banks ESG: Scope 3 is too big to ignore, as of 09/27/2024

9. Source: Autonomous Research, Global Banks, Climate Risk: More tortoise than hair, as of 10/14/2024

10. Source: CaixaBank, Sustainable Banking Presentation, as of Q2 2024; https://www.caixabank.com/deployedfiles/caixabank_com/Estaticos/PDFs/Ac…

11. Source: Moody’s Ratings, Financing the Transition – Global: Banks are cutting financed emissions, but progress will not be linear, as of 10/28/2024

Disclosures

The views expressed are those of the author and Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

The Global Sustainable Total Return Bond Fund is a UCITS fund and is not available to U.S. investors.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities or issuers mentioned. It should not be assumed that investments in such securities or issuers have been or will be profitable. References to specific securities or issuers are to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients.

Sustainable investment considerations are one of multiple informational inputs into the investment process, alongside data on traditional financial factors, and so are not the sole driver of decision-making. Sustainable investment analysis may not be performed for every holding in the strategy. Sustainable investment considerations that are material will vary by investment style, sector/industry, market trends and client objectives. Certain strategies seek to identify companies we believe may be desirable based on our analysis of sustainable investment related risks and opportunities, but investors may differ in their views. As a result, these strategies may invest in companies that do not reflect the beliefs and values of any particular investor. Certain strategies may also invest in companies that would otherwise be excluded from other funds that focus on sustainable investment risks. Security selection will be impacted by the combined focus on sustainable investment research assessments and fundamental research assessments including the return forecasts. Certain strategies incorporate data from third parties in their research process but do not make investment decisions based on third-party data alone.