Hearing, Seeing, Thinking: June 2024

Welcome to our latest edition of Hearing, Seeing, Thinking (HST). In today’s note, we take a semi-deep dive into the world of artificial intelligence (AI). We dared not go any deeper for fear of what we might find.

In the process, we address how American technology stocks are soaring, how American industry is adapting and what jobs may be at risk of disappearing. We also share a few thoughts on what that means for our current investment thinking.

But we begin today with the story behind AlphaGo and the moment when computers began to display what some describe as human intuition.

My base case is: AI is going to move so fast that there is zero chance of regulating it, stopping it, or even understanding it.

Brad Slingerlend, NZS Capital

Previously creators could explain how something worked, why it did what it did, even if this required vast detail. That’s increasingly no longer true.

Mustafa Suleyman, co-founder of DeepMind Technologies and Inflection AI

Body

What We're Hearing.

It can take years to develop a strong understanding of Go, the abstract board game invented in China more than 2,500 years ago.

A normal game starts with an empty board that is 19 by 19 lines. Each player has an unlimited supply of pieces (called stones), which are distinguished only by their colour. Players take turns placing one of their stones on the intersection of the lines attempting to score points by forming territories and capturing their opponent.

It has been said that there are more potential configurations of a Go board than there are atoms in the known universe. The game ends when both players consecutively pass on a turn, indicating that neither side can increase their score.

What makes the game so unique is that successful players require as much intuition and creativity as they do long-term strategic thinking.

In March 2016, AlphaGo, a computer program developed by London-based DeepMind Technologies, beat the South Korean professional Lee Sedol, appropriately nicknamed The Strong Stone, in a five-game match. The win marked the first time a computer topped a 9-dan professional without a handicap.

Lee Sedol retired from the game three years later. ‘Even if I become the number one,’ he said, ‘there is an entity that cannot be defeated.’

The concept of AI arguably began in 1950 when Alan Turing published ‘Computing Machinery and Intelligence’, a paper that considered the question, ‘Can machines think?’ Researchers have been working on making science fiction a reality ever since.

The defeat of Lee was a step in that direction. But Google’s AlphaGo, or even IBM’s Deep Blue which preceded it, were limited in scope. These systems ‘learn’ by being ‘trained’ on massive amounts of data. They were built to excel at a certain task, such as a highly sophisticated board game.

What researchers were looking for was a single machine capable of outperforming humans on a wide array of complex tasks.

The next breakthrough came in 2017 when Google’s DeepMind team published its work on the transformer model. We will skip over the technical bit (i.e. we really don’t understand it) and jump to the result: the near-human level writing we’ve become all too familiar with since the release of ChatGPT.

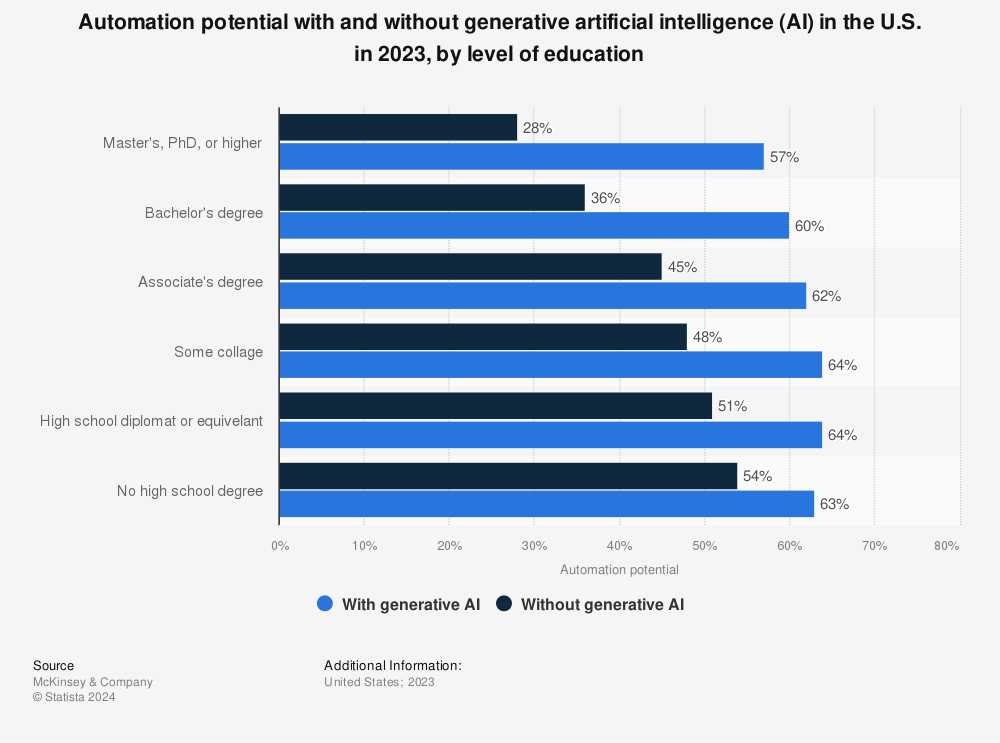

Today, AI can outperform humans in everything from reading comprehension and image recognition to our basic understanding of language (see the following chart).

So where do we go from here?

Source: Data Page: Test scores of AI systems on various capabilities relative to human performance”, part of the following publication: Charlie Giattino, Edouard Mathieu, Veronika Samborska and Max Roser (2023) - “Artificial Intelligence”. Data adapted from Kiela et al.. Retrieved from https://ourworldindata.org/grapher/test-scores-ai-capabilities-relative… [online resource]

Our next stop on the AI journey takes us to none other than Talcott, West Virginia. The railroad town of 627 sits on the edge of a steep hill that abuts the Greenbrier River in one of those dusk-in-the-early-afternoon valleys that characterise the heart of America’s Appalachian coal country.

Our focus shifts here thanks to a statue at Big Bend Mountain dedicated to a railroad worker named John Henry. Legend has it that Henry was hired as a steel driver for the Chesapeake and Ohio Railway.

The advent of the steam drill brought efficiency gains that threatened to displace even the most capable men tasked with digging tunnels. As the story goes, a challenge, ‘man against machine,’ took place, pitting Henry, the man with a 10-pound hammer in each hand, against the drill.

It was a race that Henry won, but one that cost him his life in the process.

The idea of technology taking over human jobs – whether it’s the spinning jenny, the steam-powered drill or the software coming out of Silicon Valley – is not a new concept. Supporters of tech-related displacement argue that productivity gains create demand for new products and services, giving rise to new demands for human labour.

By way of example, economist David Autor of the Massachusetts Institute of Technology estimates that roughly 60% of U.S. workers in 2018 were employed in jobs that didn’t even exist in 19401. What may be different this time is the speed at which AI-embedded technology is changing the economic landscape.

Walmart, for example, has already adopted a chatbot not too dissimilar from ChatGPT to negotiate prices, payment terms and discounts with its suppliers. The company projects that by 2026, 65% of its stores will be serviced by automation.2

Despite these productivity enhancements, America’s largest private employer has no plans to shrink its workforce. Management states that the work at Walmart will look different but will not disappear.

For now, Walmart workers may be safe. In our household, demand for human musicians (e.g. Taylor Swift), football players (e.g. Chelsea F.C.) and nannies (e.g. Norland College) also seems sufficiently secure. Nevertheless, AI is rapidly imitating a multitude of human abilities, especially those of knowledge-based workers.

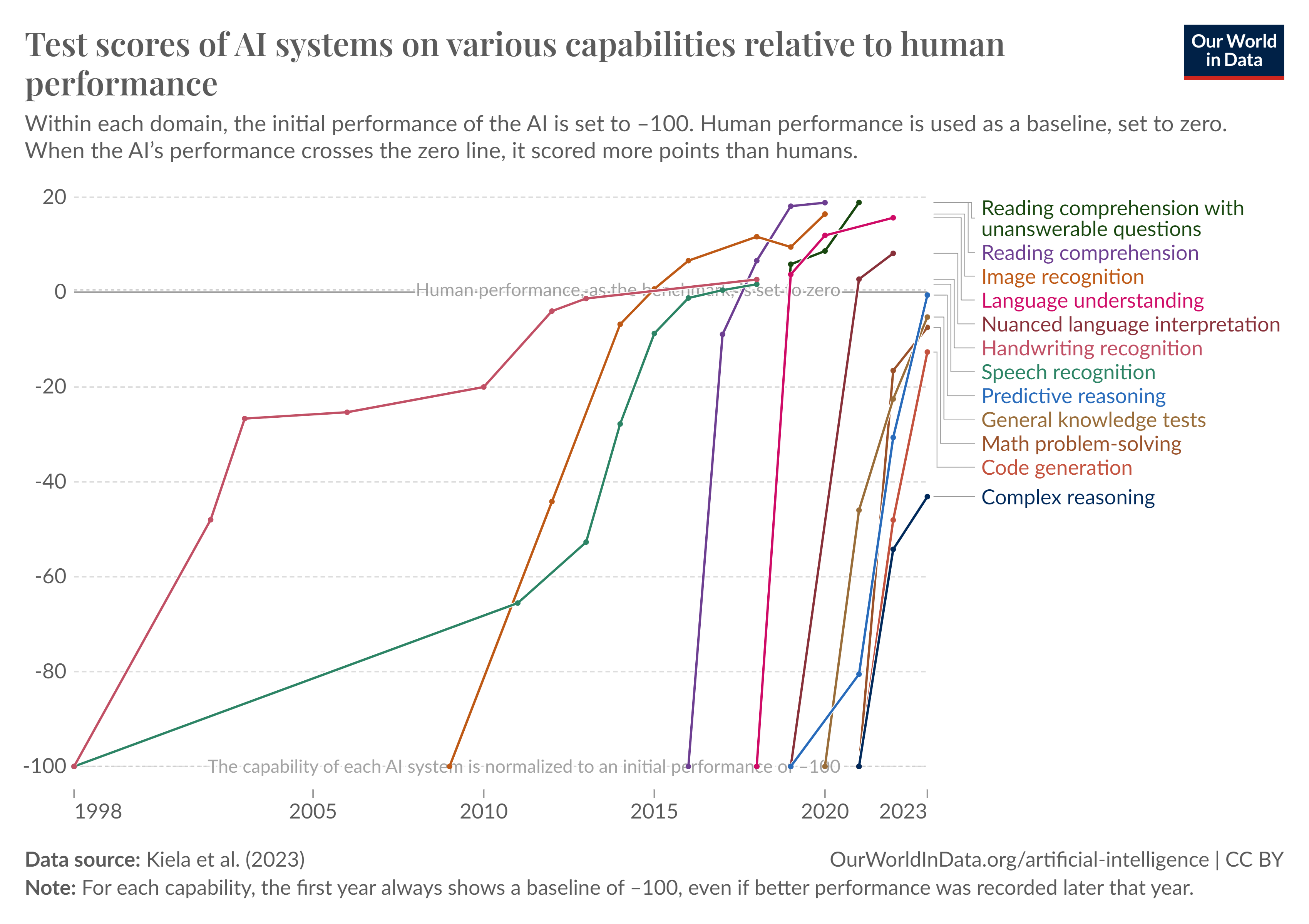

In fact, it is arguably the white-collar side of the labour force that faces the greatest risk of displacement (see the following chart). As for AI’s ability to create new jobs, there is no guarantee that most of those roles will require anything but more AI.

Mustafa Suleyman, co-founder of DeepMind Technologies and Inflection AI, notes: ‘Even those who don’t foresee the most severe outcomes of automation still accept that it is on course to cause significant medium-term disruption. Whichever side of the jobs debate you fall on, it’s hard to deny that the ramifications will be hugely destabilizing for hundreds of millions who will, at the very least, need to re-skill and transition to new types of work’.

Source: McKinsey & Company (2023). Automation potential with and without generative artificial intelligence (AI) in the U.S. in 2023, by level of education. Statista. Statista Inc. Accessed: May 31, 2024. https://www.statista.com/statistics/1411559/education-automation-potent…

Body

What We're Seeing.

To ‘google’ became a transitive verb in 2006 when two of the world’s leading English dictionaries added the neologism despite reports that Google frowned upon its use as an action. Apparently, ‘quone’ is still on the waiting list. Collins Dictionary reports that the term is currently being monitored for evidence of usage. More on that injustice in another note.

Readers who google ‘The Magnificent Seven’ will find the page littered with links to the title of a 1960 Western film directed by John Sturges. Most of our Brown Advisory colleagues have little knowledge of the film and even less awareness of its director. The same can be said for obscure Seinfeld references, such as the one in the last paragraph.

Regardless, industry awareness of ‘The Magnificent Seven’ changed when Bank of America analyst Michael Hartnett delivered an investment note that applied the term as a moniker to describe America’s leading technology companies.

Interest in these seven stocks – Alphabet (i.e. Google), Amazon.com, Apple, Meta (i.e. Facebook), Microsoft, NVIDIA and Tesla – soared in 2023 given that their collective positive performance accounted for roughly 40% of the MSCI ACWI Index’s total return. Exposure to those seven names, or lack thereof, goes a long way in explaining an equity manager’s recent performance.

Four of these seven have taken that outsized momentum into the current year. To help put their size and market influence into perspective, their combined value now exceeds every domestic stock market apart from the U.S.

Source: Bloomberg and Brown Advisory analysis. As of 28 May 2024.

It’s not clear where the share prices will go from here. The bull case for most is closely correlated to market expectations for AI and the goods and services, such as chips and cloud computing, that come along with it. For others, AI mania has fuelled fears that a bubble not too dissimilar to the 1990s is upon us.

Back then, Cisco epitomised the era of irrational exuberance. The company owned most of the router market that powered the internet.

Today, all eyes are on NVIDIA, another California-based company that has built a dominant position in a subset of the technology sector. NVIDIA leads in the production of high-end graphics processing units (GPUs). In simple terms, it’s the world’s leading developer of chips tailored for AI.

Pivoting back to Cisco, the value of its shares peaked at $552 billion in 2000. Its products certainly delivered on their potential, but the share price collapsed more than 89% in the process. Even today, shares still trade 39% below that peak despite growing free cash flow per share by 8% per year over the past 23.3

NVIDIA has also seen a stratospheric gain in its market capitalisation. It has added more than $2 trillion in value in the span of three years. For those readers without a Bloomberg terminal, that’s a staggering statistic. The company surpassed both Amazon and Google to become the third most-valuable company by market cap behind Microsoft and Apple.

That has many asking whether NVIDIA will be the next Cisco. We’ll come back with a few thoughts on that in a second. For now, enjoy the following chart.

Source: Bloomberg, as of 3 January 1995 to 21 May 2024. Price rebased to $1 on 3 January 1995, NVIDIA lagged 25 years.

Taiwan Semiconductor Manufacturing Company (TSMC) is possibly the most important company in the world.

There are multiple firms that design cutting-edge semiconductor chips. NVIDIA being one. There are also quite a few firms that design and manufacture less-sophisticated chips. But only one dominates the production of the seriously advanced logic chips for the likes of Apple, NVIDIA and others.

TSMC’s founder, once said, ‘The semiconductor business is like a treadmill that speeds up all the time. If you can't keep up, you fall off'4

He’s alluding to the enormous capital investment needed to reach the next technological frontier. Early success begets capital, which, if invested properly, leads to more success.

The positive feedback loop continues. Over time, competition to produce state-of-the-art chips effectively evaporates as the capital requirements and technological know-how increases.

Moreover, the science and engineering backstopping the production is mindboggling. There is no amount of capital that will enable an existing player, much less a new entrant, an easy catch-up. In fact, the technology behind the TSMC process has been described as the closest thing to magic we have on this earth.

TSMC earmarks over $30 billion dollars in annual capital expenditures5 for the privilege of running on that treadmill, a figure that exceeds the amount most of its competitors earn in revenue.

Earlier this year, however, The Wall Street Journal reported that Sam Altman, the CEO of OpenAI, the research company that produces services such as ChatGPT, sought to raise as much as $5 trillion to $7 trillion, an amount that surpasses the annual GDP of all but two countries, with an aim to build his own production capabilities and help solve the constraints to OpenAI’s growth.6

To be fair, there are also huge sums of capital needed to both build and power the datacentres on which AI depends. Nonetheless, the potential use cases for the products and services of such companies as NVIDIA, Microsoft and Google are incredibly large.

So large, in fact, that we lack both the capacity and imagination at this point to make a reasonable guess.

Source: Buchholz, K. (2023). Advanced Microchip Production Relies on Taiwan. Statista. Statista Inc. Accessed: May 31, 2024. https://www.statista.com/chart/30041/global-semiconductor-wafer-fabrica…

Broadly speaking, valuations in America’s technology sector are lofty, but in our view they do not reflect the unbridled enthusiasm associated with the introduction of the internet in the late 1990s.

Part of the reason being that many technology companies have little-to-no direct connection with AI.

Those that do benefit from the growth of AI can generate significant amounts of cash from existing revenue streams. According to our technology analysts, ‘that’s the one thing (i.e. free cash flow) that none of the companies had in 2000’.

As for an AI bubble, we see little evidence.

Body

What We're Thinking.

We think that there are multiple investment angles around the opportunity set for AI.

As noted above, if a company reaches a certain size, it becomes almost impossible for a competitor to catch up. Scale becomes the proverbial moat. So, at the risk of sounding run-of-the-mill, we still think there are a subset of incumbents (e.g. Microsoft, Google, TSMC) that will continue to thrive.

On the other end of the spectrum, we also think that great founders want to be working with great firms. As a result, the leading names in venture capital7 are arguably very well placed, especially in a world where a higher cost of capital prevents any Tom, Dick and Harry from cutting a cheque.

We also think a picks-and-shovels approach makes a great deal of sense.

Our partners in the infrastructure space believe that global trends of cloud computing, digitalisation and adoption of AI continue to drive a step-change increase in demand for both datacentres and the amount of renewable energy needed to power them.

Moreover, we believe large corporate consumers of power (e.g. Microsoft) prefer to work with providers that have the scale, operational expertise and access to large pools of capital. Again, scale becomes the competitive advantage.

Rich, proprietary data sets are another angle worth considering. Like any system, the quality of the output is determined by the quality of the input. In other words, garbage in, garbage out. As the algorithms naturally become commoditised, we think the data becomes the scarce resource.

In 2019, James Mackintosh of The Wall Street Journal wrote a piece entitled “The Agony of Hope Postponed, by a Value Investor”.8

Mackintosh astutely observes how history suggests that technological revolutions create a new cluster of leading stock market disrupters. New winners are established. They grow and mature into the household names of the next generation.

During the early decades of the last century, it was the likes of General Motors, General Electric and the successors of Standard Oil that were trading at valuation premiums to the proverbial ‘old’ industries, such as steam-driven railroads, utilities and shipbuilders.

Today, it’s the champions of Silicon Valley that are growing at the expense of printed publishing, high-street retail and the traditional media that my generation would readily recognise.

Some old industries, however, eventually tend to benefit from adopting new technologies, ‘just as beaten-up coal railroads became stock-market winners when they shifted to diesel trains’.

Today, it’s American innovation leading the global transformation from the industrial age to the information age. And while the Dutch produced a one-of-a-kind leader in ASML, the company which makes the machines TSMC uses to print chips, Europe has yet to produce a set of technological champions that can compete with the likes of Microsoft, Apple, Google, Visa, Amazon, NVIDIA and whatever comes out of Silicon Valley next

In our view, the hope for Europe stems from the productivity gains associated with adopting new technologies, the Walmart example discussed above serves as one primary example.

We think that transformation will come, but it will take time. Until then, America marches on.

We have no pictures to complement the editorial in our last bullet, so we include one of Alice, the newest member of the HST family, who recently turned one. How’s that for a little humanity in an increasingly machine-driven world?

Daddy loves you.

Until next time,

Christopher ‘Kif’ Hancock

CIO International

1 Source: https://economics.mit.edu/sites/default/files/2022-11/ACSS-NewFrontiers…

2 Source: https://www.reuters.com/business/retail-consumer/walmart-says-65-stores…;

3 Source: Bloomberg. Cisco’s shares peaked on 27 March 2000.

4 Morris Chang, Founder of TSMC, https://archive.computerhistory.org/resources/access/text/2012/05/10265…

5 Source: Bloomberg

6 Source: https://www.wsj.com/tech/ai/sam-altman-seeks-trillions-of-dollars-to-re…;

7 Alternative investments available for Qualified Purchasers and Accredited Investors only.

8 Source: https://www.wsj.com/articles/the-agony-of-hope-postponed-by-a-value-inv…;

Disclosures:

The views expressed are those of the author as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

Alternative investments may be available for qualified purchasers or accredited investors only.

The information provided in this material is not intended to be and should not be considered to be a recommendation or suggestion to engage in or refrain from a particular course of action or to make or hold a particular investment or pursue a particular investment strategy, including whether or not to buy, sell, or hold any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. To the extent specific securities are mentioned, they have been selected by the author on an objective basis to illustrate views expressed in the commentary and do not represent all of the securities purchased, sold or recommended for advisory clients. The information contained herein has been prepared from sources believed reliable but is not guaranteed by us as to its timeliness or accuracy, and is not a complete summary or statement of all available data. This piece is intended solely for our clients and prospective clients, is for informational purposes only, and is not individually tailored for or directed to any particular client or prospective client.

Any business or tax discussion contained in this communication is not intended as a thorough, in-depth analysis of specific issues. Brown Advisory does not render legal or tax advice. Prior to making an investment decision, a prospective investor should consult with its own legal, tax, accounting and other advisors to determine the potential benefits, burdens, and other consequences of such investment.

Definitions of indices used are below. An investor cannot invest directly into an index.

The MSCI ACWI® Index, MSCI’s flagship global equity index, is designed to capture large and mid cap representation across Developed Markets (DM) and Emerging Markets (EM) countries. The Index covers approximately 85% of the global investable equity opportunity set. All MSCI indexes and products are trademarks and service marks of MSCI or its subsidiaries.

The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Forward Price to Earnings ratio (P/E) divides the current share price of a company by the estimated future (‘forward’) earnings per share (EPS) of that company.

Free cash flow (FCF) represents the cash a company generates after cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the non-cash expenses of the income statement and includes spending on equipment and assets as well as changes in working capital.

BLOOMBERG is a trademark/service mark of Bloomberg Finance L.P., a Delaware limited partnership, or its subsidiaries. All Rights Reserved.

The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS), “GICS” and “GICS Direct” are service marks of Standard & Poor’s and MSCI. “GICS” is a trademark of MSCI and Standard & Poor’s.