It’s important for investors to understand how the primary and secondary markets power many of the unique benefits of ETFs. The ETF ecosystem is vast, with multiple participants tasked with providing access, liquidity, and fair pricing. Add tax efficiency into the mix, and it’s easy to see why ETFs have become the vehicle of choice for so many investors.

Think of an ETF as a wrapper or a box. It’s simply the packaging that holds a group of securities based on its investment objective. One ETF may track a specific index, another may be actively managed and purchase stocks of only biotech companies or only healthcare companies, while another may focus on bonds from various municipalities. Regardless of the investment objective, the important thing to remember is that each ETF is made up of different individual pieces. The ability to assemble, break down, and reassemble those individual pieces, called the creation and redemption processes, is what drives both the liquidity and the potential tax benefits of ETFs.

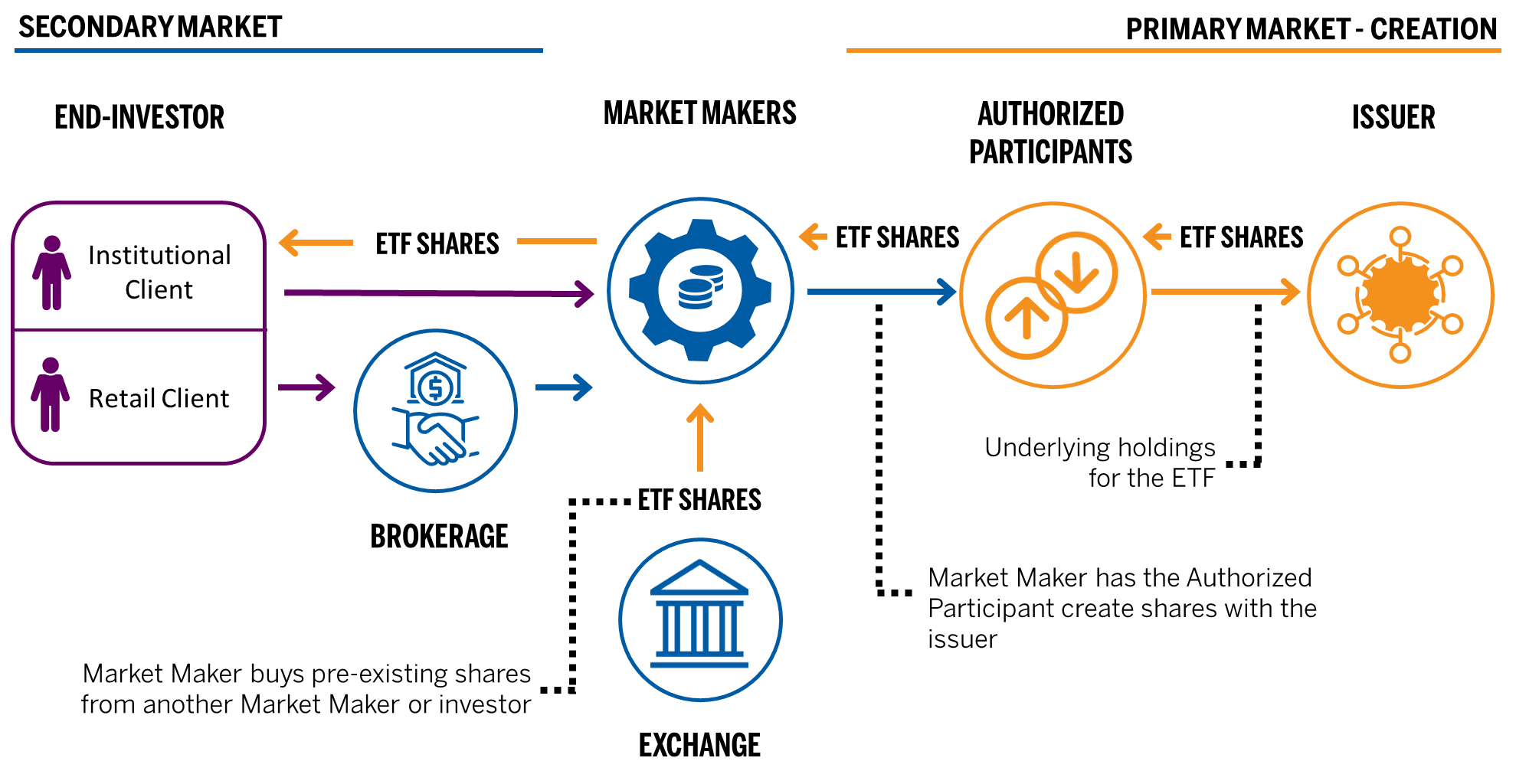

After a buyer (retail or institutional) places an order for an ETF, there are multiple ways traders can source the shares for that end-investor’s account. ETF traders can operate in two markets: on the secondary market, which involves buying and selling shares that currently exist on an exchange, or on the primary market, where ETF share creation and redemption orders take place. The creation order process results in new shares of the ETF being made from an ETF’s individual holdings and added to the previously existing ETF shares outstanding on the exchange. Conversely, the redemption order process breaks down existing ETF shares into their individual components and removes them from the pool of ETF shares trading on the exchange. Here’s a rundown of the ETF transaction lifecycle for a buy order and the key players involved in the ETF primary and secondary markets:

Key Players

ETF Issuers

Issuers are the companies that sponsor ETFs, list them on an exchange (such as Nasdaq), and manage the fund. When a new ETF comes to market, it’s funded with seed capital — typically from a bank, a major investor, or the ETF issuer itself. The seed capital is used to buy the securities that will form the initial shares of the ETF listed on the exchange.

Exchange

Exchanges, like Nasdaq, are regulated platforms where companies/issuers can list their shares, and traders meet to buy and sell. Exchanges host the secondary market.

Authorized Participants

Authorized Participants (APs) are allowed to place creation and redemption orders directly with ETF issuers. This allows APs to give issuers underlying holdings to receive created ETFs shares, or to redeem existing ETF shares with issuers to receive the underlying holdings. APs are typically banks, but can be any self-clearing broker-dealer either acting as an agent, processing creations and redemptions on behalf of investors or market makers, or acting as a principal, creating and redeeming when it’s profitable for managing their own exposure. Market Makers can also be APs acting in a principal capacity.

Market Makers

ETF Market Makers (MMs) are trading firms that specialize in facilitating the buying and selling of ETF shares on the exchange, offering ongoing daily access to ETF shares for investors. Market Makers buy when investors want to sell and sell when investors wish to buy — and profit on the difference in price between those transactions. They may also have APs submit creation and redemption orders on their behalf.

Investors

From individuals to institutions, investors are the end-buyers or end-sellers of ETFs.

All investments involve risk, including possible loss of principal. Please see each product's web page for specific details regarding investment objective, risks, performance, and other important information. Review this information carefully before you make any investment decision.

Carefully consider a fund’s investment objectives, risks, charges and expenses before investing. Click here for a current prospectus. Please read and consider it carefully before investing. You may obtain a hardcopy of the prospectus by calling 1-877-876-6383.

The views expressed are those of Brown Advisory as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be and should not be relied upon as investment advice and are not intended to be a forecast of future events or a guarantee of future results. Past performance is not a guarantee of future performance and you may not get back the amount invested.

Brown Advisory does not provide accounting, tax or legal advice. A prospective investor should therefore not construe the contents of this document as investment, legal, tax, regulatory, financial, accounting or other advice.

An Exchange-Traded Fund (ETF) is a type of investment fund and exchange-traded product, meaning it is traded on stock exchanges. ETFs hold assets such as stocks, commodities, or bonds and generally operate with an arbitrage mechanism designed to keep trading close to its net asset value, though deviations can occasionally occur. ETFs offer investors a way to buy a broad portfolio of assets in a single transaction, providing diversification and typically lower costs compared to other types of investment funds.

ETFs may trade at a discount to their NAV and are subject to the market fluctuations of their underlying investments. ETFs are subject to Brown Advisory management fees and other expenses, which will reduce performance.

The Brown Advisory Exchange Traded Funds (ETFs) are distributed by SEI Investments Distribution Co. (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456. Funds are managed by Brown Advisory LLC. SIDCO is not affiliated with Brown Advisory LLC.